Swiss Federal Tax Administrator (EStV)

Online tax calculator 2.0

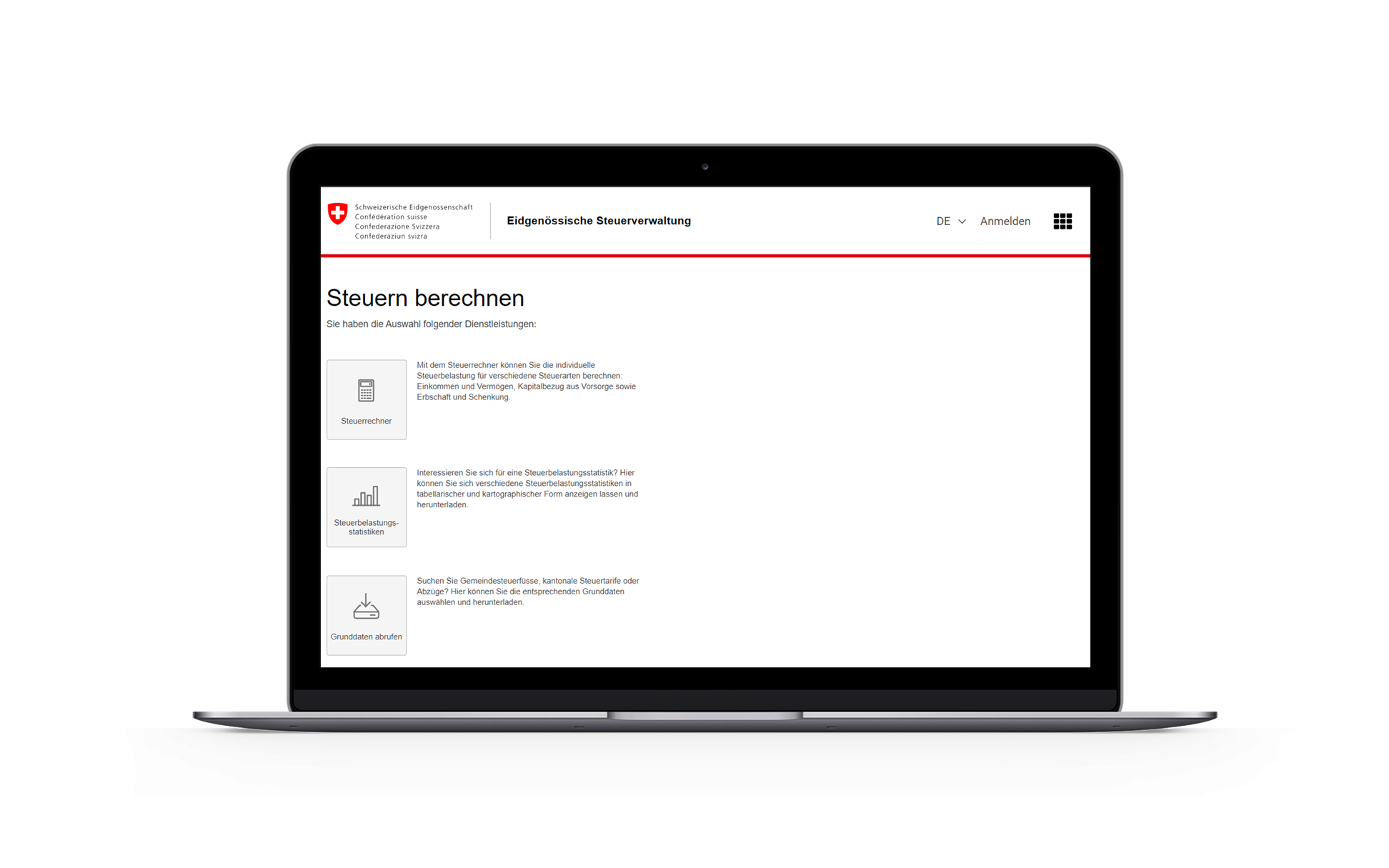

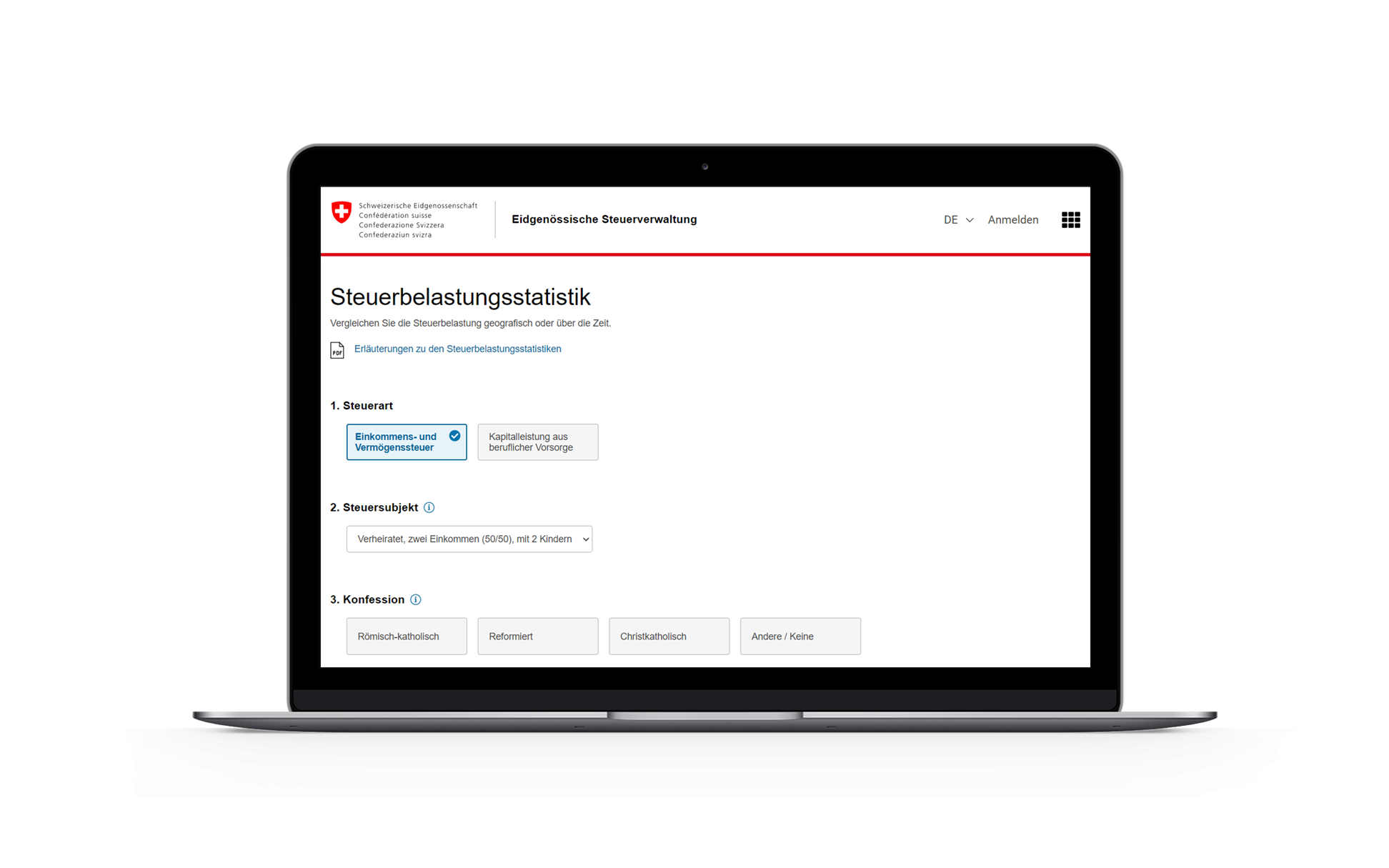

The new online tax calculator – modern and intuitive

Tax calculations are highly complex and require knowledge of a huge amount of detail. The previous tax calculator needed to be redesigned and modernized. The printed publication The Tax Burden in Switzerland also needed to be integrated and properly digitalized.

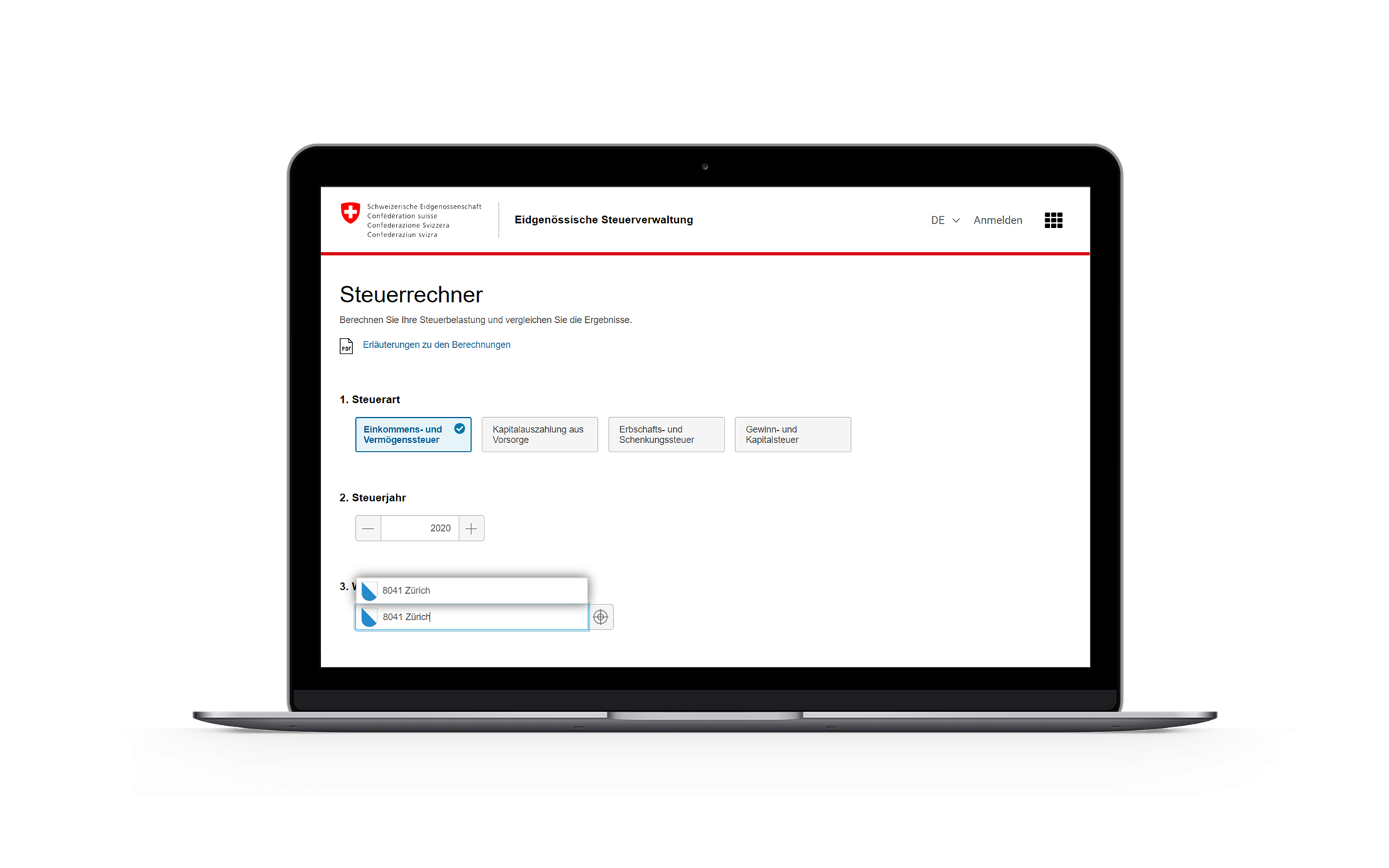

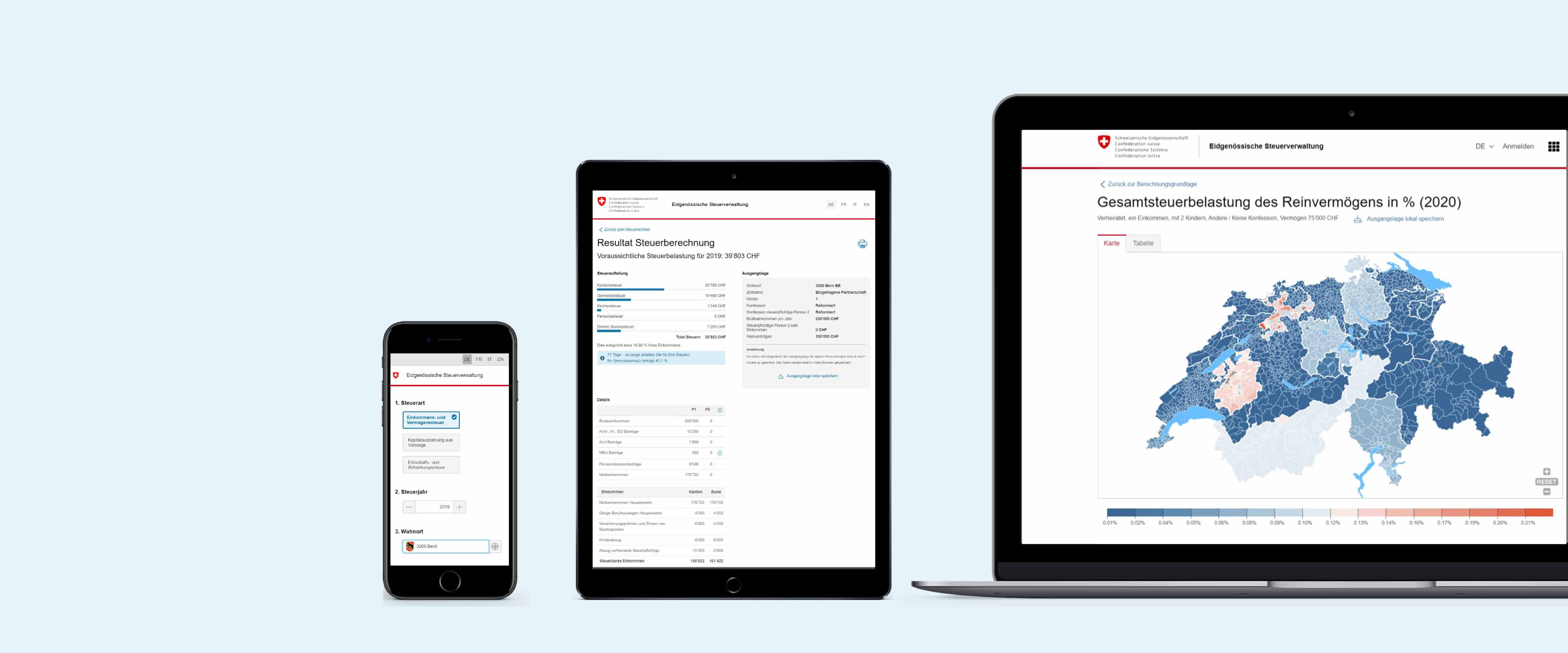

ti&m developed an online tax calculator for the Swiss Federal Tax Administration (EStV). This modern, intuitive online tax calculator allows users to calculate the tax on income, assets, inherited assets, and capital benefits from pensions for all municipalities. Users can also compare different municipalities and calculate the effects of upcoming changes in personal circumstances (marriage, pay rise, etc.) on their tax payments.

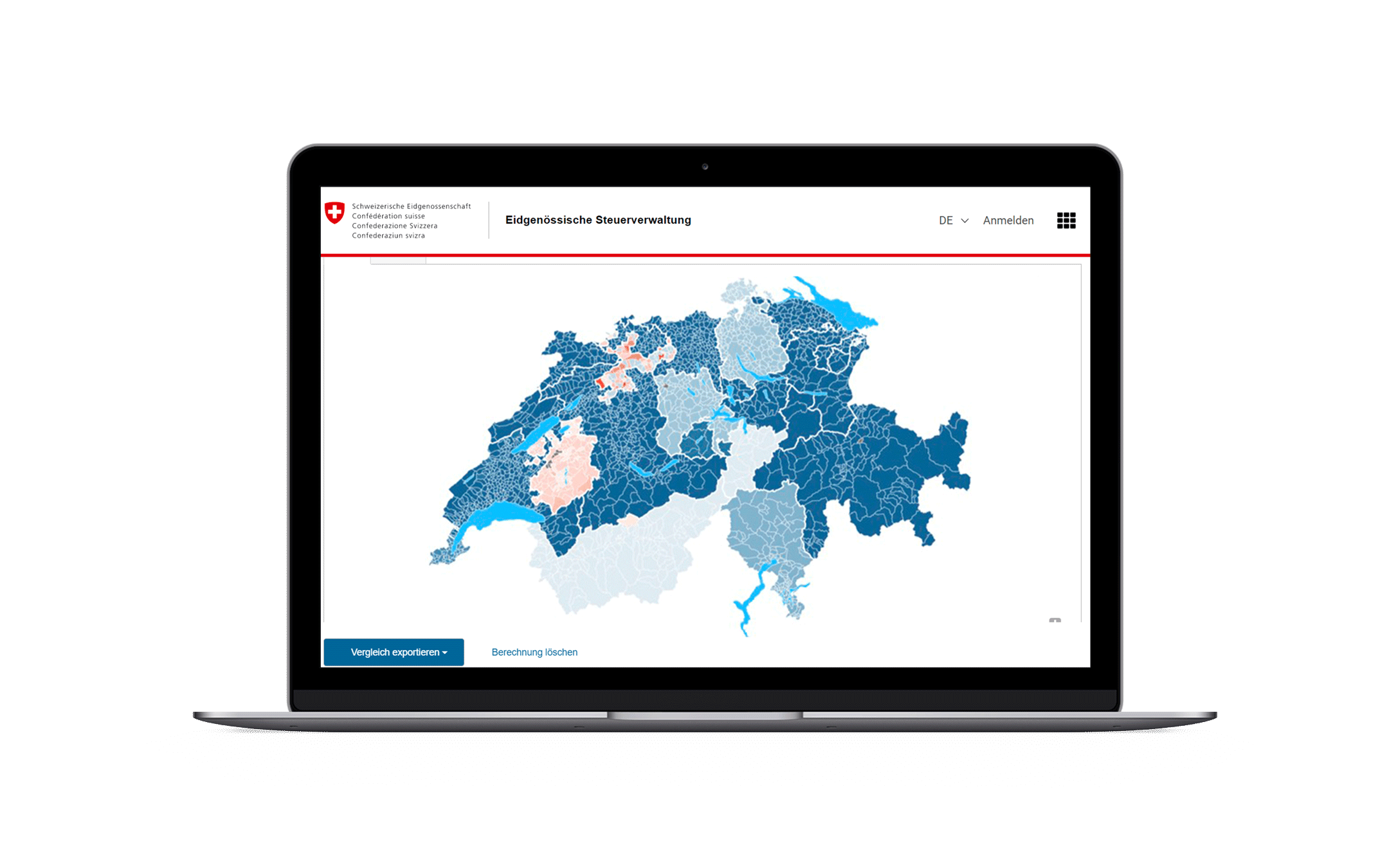

An additional module known as “Tax burden statistics” enables different calculation modules to be generated interactively and displayed either as a table for multiple tax years or as a map for the whole of Switzerland. The basic data module includes historical tax data (deductions, tax rates and multipliers), which can be downloaded for study purposes, for instance. The calculator is administered by the EStV via the tax editor backend. Users can log in via the federal e-portal.

The Swiss Federal Tax Administrator (EStV) and ti&m worked together using the agile Scrum approach to enable the client to verify that the planned project goals had been reached after each sprint (every two weeks). Overall progress was mapped on a release burn-up chart and submitted to the steering committee.

“The online tax calculator has over 1,000 users per day – the figures alone tell a clear story. The Swiss Federal Tax Administration also receives a lot of positive feedback from users.”– Roger Ammann, Swiss Federal Tax Administration

Can be implemented anywhere in Switzerland

Record all key entry data with just a few clicks. Available in multiple languages (DE, FR, IT, ENG). Meets the W3C WCAG 2.0 Level AA accessibility requirements.

Head of eGov & Industries

Magdalena Koj

Want to know more about the project or product development? I’ve got the ideal solution!