VZ finance portal — more than just e-banking

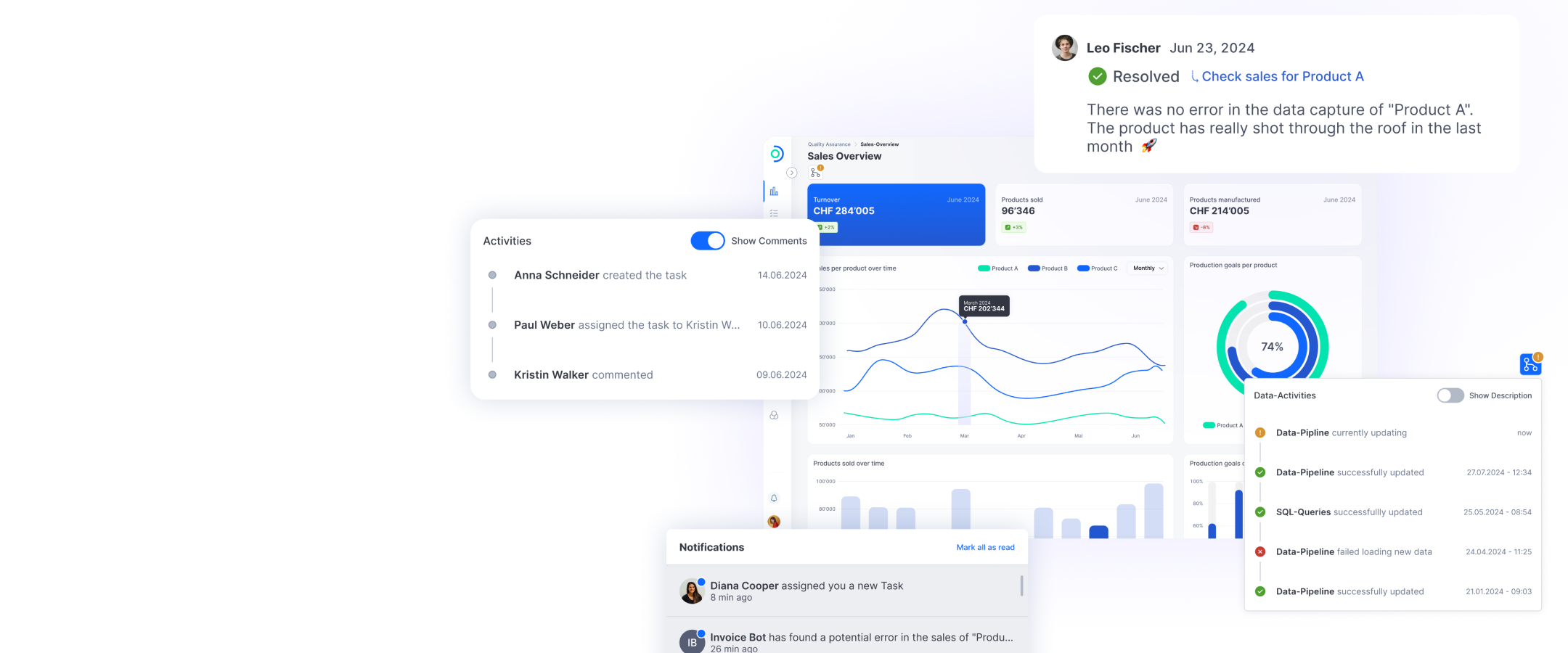

VZ is renowned for its highly-qualified and expert consultancy and its holistic solutions, which are always designed with the customer in mind. This kind of holistic service includes far more than conventional e-banking offers. So as well as payment transactions and security holdings, areas covered by our portal include health data, wills, insurance, pension fund statements, property valuations and tax documents. The VZ finance portal is designed to address the real needs of our customers.

Innovation put to the test

It’s only logical that such a broad mix of areas can’t be procured via a single technical platform. For VZ, therefore, it is very important that we integrate different providers and solutions. We have always developed our own genuine VZ USPs. Ten years ago, our capacity for innovation led us to launch Europe’s first robo advisor. It’s a solution that is still available today, and manages over one billion Swiss Francs in pension fund pillar 3a alone. For about a year, the 3a solution has also been open banking compatible and is being used with great success by fintech firm Selma Finance. Others will follow.

But it’s also vital to bring in third parties. For this reason, VZ customers were this year given direct access to an automatic property valuation service via the VZ finance portal. The portal uses machine-based learning to calculate the daily market price. Properties are therefore no longer tedious consolidation lines in the portal; instead, they behave similarly to stock prices. We embedded the PriceHubble solution in order to add this service.

Hybrid solutions in demand

Our pioneering work in robo advice quickly taught us that purely digital solutions can have a bumpy ride with customers, particularly when arranging asset shares or dealing with complex issues. It is therefore crucial to ensure that a digital solution is supported by equally strong in‑person advice. Hybrid is definitely the way to go, and this is why we are continually developing our VZ finance portal and our branch presence. The experience that is by far the most popular with our customers is a seamless interface between physical and digital channels.

At VZ we foster an open and innovative culture. Everything is geared towards our customers. Our innovation program, ARENA, primarily promotes ideas that benefit customers, and our innovations backlog is therefore bursting at the seams. However, our current technical structures, are preventing us from making rapid progress. Many of our structures are monolithic, and too inflexible. Seeking a set-up that would offer greater speed, agility, flexibility and scalability, we arrived at the ti&m solution after a long tender process.

The overwhelming benefits of migration

Of course, as a financial services provider, it’s hard to make this kind of decision. A project to migrate to a new platform brings risks and costs. After thorough analysis, however, we came to the conclusion that these were significantly outweighed by the opportunities. Not only will we be able to work through our innovations backlog more quickly on a modern, scalable platform, the modern, cloud-compatible infrastructure will bring commercial benefits.

We are now a few months into building the platform and migrating customers over. Collaborating with ti&m has so far been a very positive experience. Their agile and forward-looking mindset is a great fit with the VZ culture. According to our project schedule, we are set to go live with the new platform in the first quarter of 2021. We’re all looking forward to that moment! But we’re especially looking forward to what will follow: a future-proofed set-up, short release cycles, collaboration as equals and, above all, a considerably shorter time-to-market for our innovation backlog.

Innovation is often blocked by technical limitations. But it’s very important to move fast as an organization, in order to develop a high aptitude for learning. If small projects and initiatives become complex and expensive, this too can nip innovation in the bud. Often, all we can do is to admire how fast the new fintech competition can move. But at VZ, we don’t want to just admire; we want to call the shots ourselves. We are convinced that our strategic priority as an organization should be to leave the old days behind and consistently pursue maximum ingenuity and skill. And in ti&m we have found the right partner to help us do just that.