“Disruption isn’t off the menu. It’s just taking a bit longer.”

ti&m: Valiant is on a growth trajectory and, contrary to current trends, is expanding its network of branches. What is the reason behind this? Shouldn’t Valiant be placing a much greater focus on its digital channels?

Markus Gygax: Physical proximity to customers is still a key aspect of how banking operates today. And this is especially true in the SME segment, where we have always been a very strong player. Customers still want to have a one-to-one conversation with a person when making complex transactions in particular, because they’re often uncertain when it comes to financial matters. So if we as a bank want to grow, we have to expand our physical presence – it’s as simple as that.

But building branches is incredibly expensive.

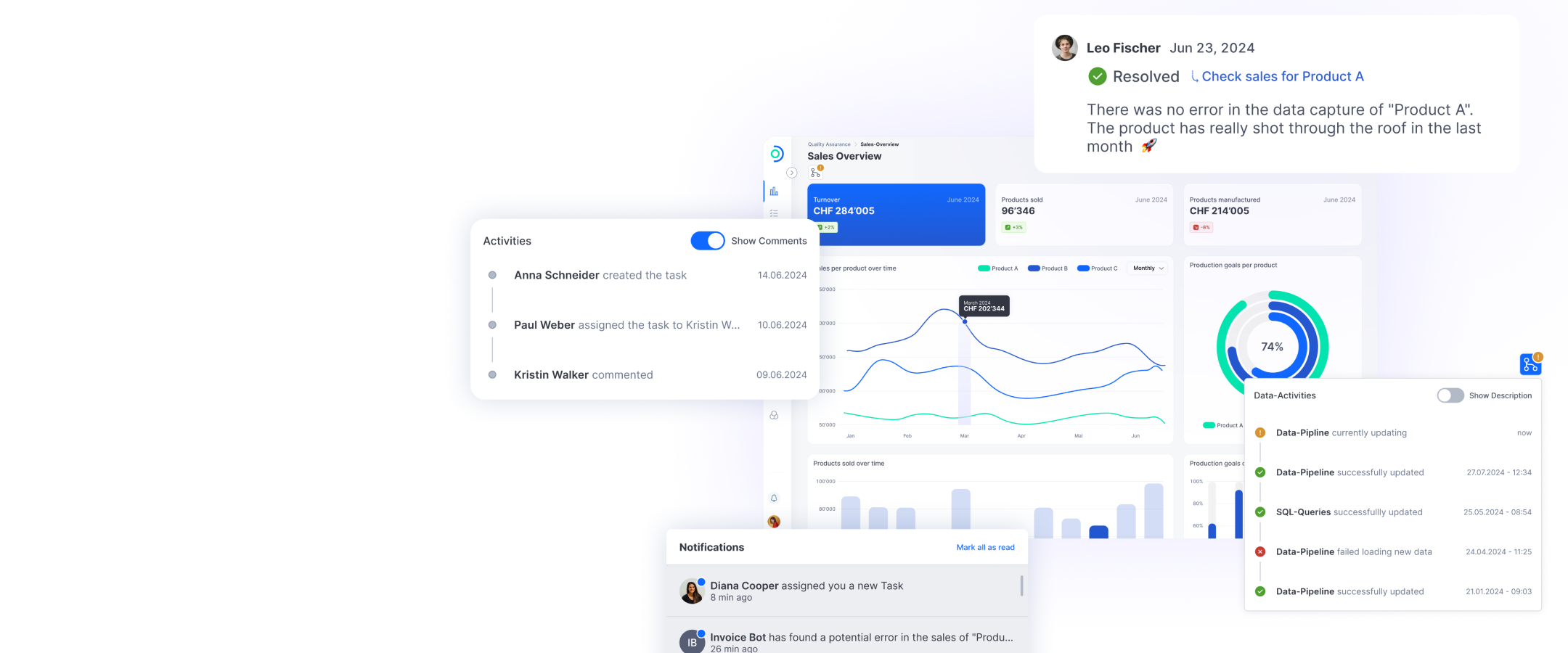

Branches are changing rapidly: Fewer and fewer transactions are being carried out at the counter, which significantly reduces the costs of building new branches. The focus is on sales – on advice and the sale of financial products for retail customers and SMEs. At the same time, we are, of course, very focused on the cost situation. That’s why we’re simplifying our processes and automating our work as much as possible.

And what role do digital channels play in this?

Digitalisation is causing permanent changes in banking – I’m certain of that. But the change isn’t happening as quickly as people expected just a couple of years ago. Disruption is happening; it’s just taking longer than we imagined it would two or three years ago. As I said, customers still need a human face when it comes to complex matters. However, most interactions between customers and their banks will be digital in the medium to long term.

How much time do Swiss retail banks still have to adapt to this?

The long-term focus of the balance sheet business model provides general protection for the banks. What’s more, customer behaviour has proved to be very stable in recent years; customers are loyal. They continue to place a high level of trust in banks, and customer satisfaction remains similarly high. In other words, retail banks still have sufficient time to adapt to the changes.

How do Swiss retail banks need to position themselves in order to survive the digital transformation?

I think there are two areas for action here: On the one hand, the existing business model needs to be digitalised, and on the other, it needs to be expanded or updated.

Let’s start with the first part: How can the existing business model be digitalised?

First and foremost, I think this means that existing processes need to be simplified and offered to customers as self-service transactions. But the expectations have to be realistic here: We were the first bank in Switzerland to offer digital onboarding, that is, a fully digital account opening process. Three to four per cent of our new accounts are opened via this channel today. That’s an almost insignificant amount. However, we will need to offer this option in the long term; there’s no way around it. The figures will increase over time. We have seen this kind of development in the past with many new services, such as e-banking. Customers are very slow to change the way they handle money.

Simplifying existing processes usually isn’t a simple task.

No, not at all. We have a clear approach to this. The only way we can simplify processes for customers is if they are also simple for our staff. That’s why we start with employees’ workstations – with the tools employees work with every day. Their work should be as simple as possible. This is the only way to simplify processes and services for customers as well.

And now the second area of action: How will Valiant change its business model? Only a few established businesses have succeeded in doing this so far.

Our approach is simply to try things out. For example, we will be testing a new offer in the mortgage segment in St. Gallen next year. We will be advising our customers as we always have in practical terms, but we’ll also be brokering mortgages from other providers. In other words, we will not be including the transactions on our balance sheet. If the project is successful, we will consider ways of rolling this out to the rest of the bank. I think a hybrid model, for example, is one conceivable option.

What would such a hybrid model look like?

Simple cases where we can’t be competitive on price would be referred to third parties. We’ll include the complex cases on our own balance sheet. This would minimise risks as well as simplifying our equity position.

And what will you do if the model doesn’t prove to be successful?

In that case, we’ll bring the exercise to an end and simply offer our customers Valiant mortgages as we have before. We took the same approach in April 2018 with our SME portal, for example, which clearly did not meet our customers’ needs in that form. We closed the portal and looked for new solutions.

How can Valiant go about establishing this trial-and-error culture?

I definitely see it as a top-down process. We have embedded sales channels as an executive board issue. This is where we decide on the measures and implement them. That’s how we’ll change the bank, and we naturally need the right people to do so.

Customers have a high level of trust in banks, and their business model is extremely stable. Margins may be under pressure, but this is more than compensated for by increasing volumes in the financing market. What do you think ultimately poses a risk to Swiss banks?

For one thing, customers are getting used to digital services, and the banks simply have to keep up with this. A bank can’t use this to differentiate itself, but it does need to meet the standard. On the other hand, there is a process that has been underway for some time now: Many sources of income for banks have dried up in the last 20 years. Municipal financing is one typical example; another is leasing machinery. In mortgage lending, banks are currently losing price-sensitive customers because we can’t keep up with the prices offered by insurance companies and pension funds. They’re now being joined by platforms like Revolut, which will eat up another chunk of our earnings in the credit card and foreign exchange business. Banks therefore need to think about new business models so that they don’t end up as niche providers that handle the complex mortgage cases.

Does Revolut have the potential to shake up the market?

Revolut is a very interesting example. On the one hand, these platforms naturally make it very simple: If you offer something for nothing, you gain customers. But it’s questionable whether that can be monetised later on.

But it’s primarily the data that will be monetised, and not the banking services.

Yes, that’s exactly the interesting thing about Revolut. It’s not a bank, but rather an IT service provider that does banking. A company like that is able to rethink banking. But that will only work on a large scale and with large numbers of users. A platform of that type can only function at the international level. In Switzerland, only a few large banks such as Raiffeisen, PostFinance, and UBS would be in the position to generate

And how can Valiant protect itself against such platforms? There’s a risk of losing the interface to customers.

We have to vigorously defend it; that’s for sure. At the moment, we’re in a comfortable position because we have a high frequency of contact thanks to online banking. I think that open API initiatives like PSD2 are essential. We as a bank need to be able to make customers’ lives easier by consolidating the various platforms and bank accounts that they use. This will ultimately become important in the SME segment. We also need to examine how we can integrate ourselves into new ecosystems like Klara. Even if we lose the direct interface to the customer there, we can provide our services in a context that makes sense for customers.

And how will a retail bank differentiate itself in the future?

That’s a question that we’re focusing on a lot. For the moment, the answer is clear: by giving the bank a strong foothold at the local level and staying close to our customers. But we are still looking for the key features that can differentiate a bank in a digital world – aside from the price.