Data Fusion

Get more out of your core data – without any code

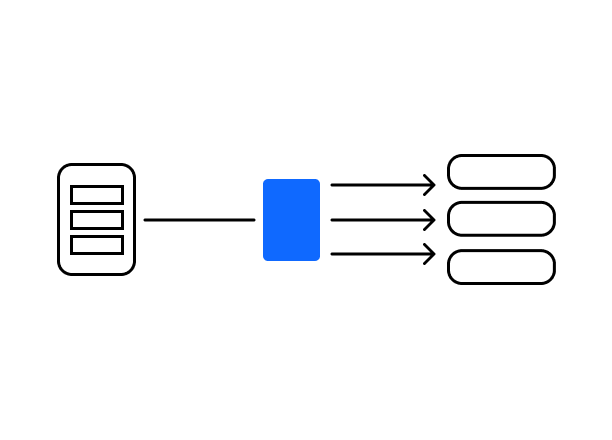

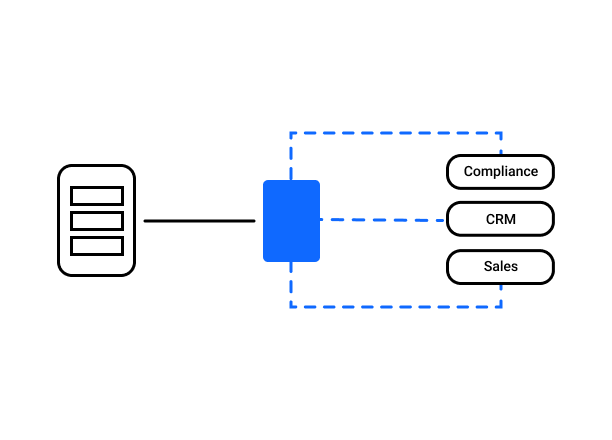

Data Fusion is a no-code solution that provides data from core systems in a flexibly configurable manner via modern interfaces. Third-party applications such as compliance or CRM systems can use this data directly to implement new business cases, without spending a lot of time and effort on integration.

New business cases in days instead of months, thanks to Data Fusion

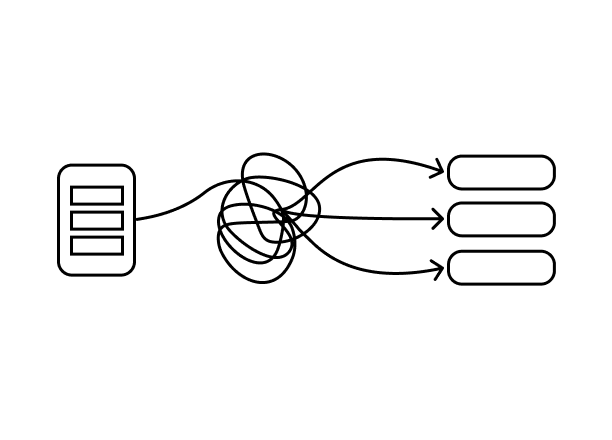

Banks have to continually expand their digital services and applications. To do this, they need various customer and bank data, which is often stored in core systems. Until now, the only way to make this data available has been through complex integration projects. The high costs involved mean that small or medium-sized projects in particular do not get implemented. New solutions are needed to realize projects more quickly, more efficiently, and more cost-effectively.

Data Fusion makes this possible. It replaces recurring integration projects and creates a flexible bridge between core banking systems and other applications.

Data Fusion makes digital transformation faster and more flexible

Set up new applications in a fraction of the time

Applications, projects, and new use cases can be provided with the necessary core data quickly and easily.

Adapt and expand new solutions quickly

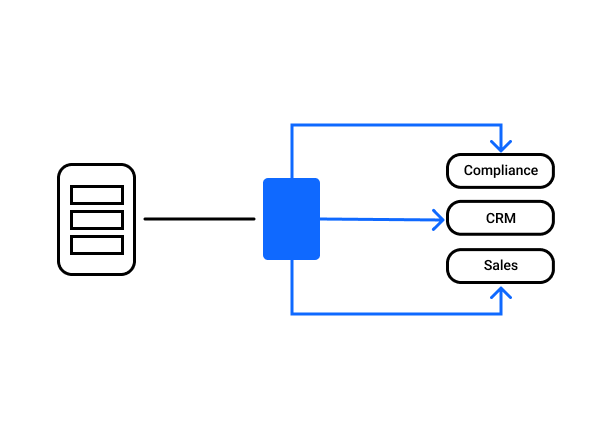

Data products that form the basis of the use cases can be easily adapted to new requirements at any time. This means banks can react quickly to the needs of stakeholders or the market, enabling them to speed up their responsiveness and boost their flexibility.

Drive the bank’s capacity for innovation

Making data supply simple means that even smaller business cases or efficiency-boosting projects can be implemented. This enhances the bank’s response speed and innovation capabilities.

Explore the functionalities of Data Fusion

Individual use cases in one or more applications can be implemented using the same data source.

No-code configuration

Flexible Data Model

Composable data products for diverse use cases

Independent and flexible interface modeling

One foundation for multiple processes: how Data Fusion is being used

Head Banking Innovations

Roger Zuberbühler

Do you have any questions about ti&m Data Fusion? We look forward to hearing from you.