Customer advisory services in the metaverse

Metaverse // A number of companies have taken their first steps into the metaverse in recent months. In the fall of 2022, digital asset bank Sygnum became the first Swiss bank to open a hub on Decentraland. We asked Prof. Andreas Dietrich about the relevance this topic has for banks here in Switzerland.

Sygnum was the first Swiss bank to enter the metaverse. How interested would you say the Swiss banking sector is in the metaverse?

There is a certain amount of curiosity about this topic, but on the whole, it’s not a strategic priority for the banks right now.

We are currently in the midst of the second metaverse wave. While the first wave consisted almost exclusively of a second life for gamers, now the economic sector appears to be increasingly interested in it as well. Is the metaverse set to go mainstream this time around? And which sectors will be affected most, both positively and negatively?

A number of uncertainties have yet to be resolved, and the technology is still very young. It’s true that the big tech companies are investing a lot of money in developing their own metaverses, and a number of artists have already demonstrated that the topic has great potential, including from a commercial perspective. But as things currently stand, we are really only in an initial experimental phase, and the results are sobering in some cases.

The banks venturing into the metaverse for the first time are primarily based in South Korea or the English-speaking world. Is the financial market in Switzerland tending to wait and see what experiences others have first?

Yes, that does appear to be what’s happening right now. But even in Korea and English-speaking countries, only a very few banks are actively addressing the topic right now.

“Neither banks nor an overwhelming share of their customers are concerned with the metaverse for now. Web 3.0 remains a long way off.”– Prof. Dr. Andreas Dietrich

Virtual branches tend to be associated with neobanks and very digital-savvy customers. How much sense do you actually think it makes for traditional banks to get involved in the metaverse? Are the banks the ones who aren’t ready, or is it the customers?

Right now, traditional banks are still working on the transition from Web 1.0 offerings, such as websites and e-banking solutions, toWeb 2.0 services with modern communication options that are compatible with smartphones, like chatbots. So, Web 3.0 development, which is still having very little impact rightnow, remains a long way off for most institutions. Neither banks nor an overwhelming share of their customers are concerned with this topic for now. In this respect, this

What tangible opportunities does the metaverse offer banks?

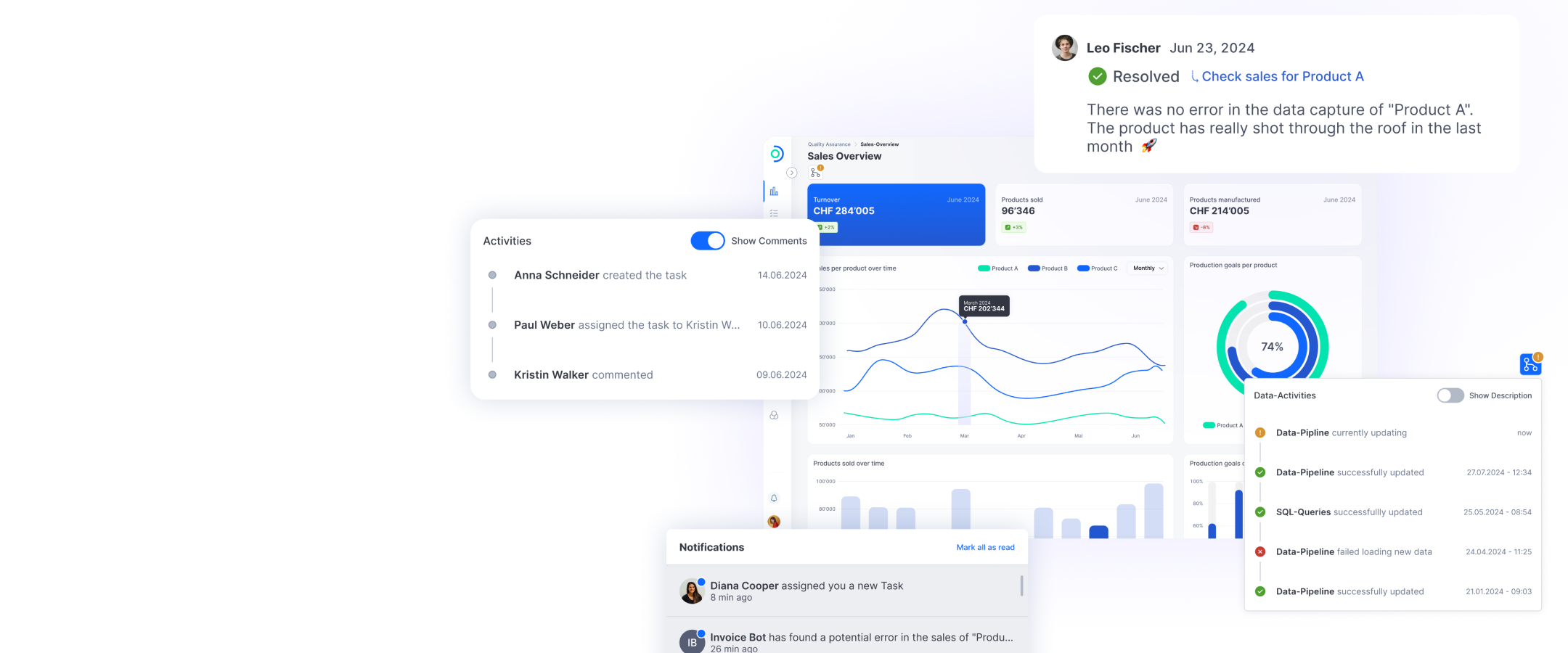

I think there will be a range of different possibilities over the long term. The metaverse could be helpful when buying and selling actual real estate. If someone is interested in purchasing a property, they could take a hybrid tour in real time that is supplemented by elements of virtual and augmented reality – in other words, a virtual tour with a real estate agent. The lending business could potentially gain in importance via the metaverse as well. Besides this, the metaverse gives banks new touchpoints for interacting with their customers: Meetings in virtual branches can offer banks an interesting opportunity to provide more personal encounters that feel more “physical” – rather than phone calls or online consultations – and to consolidate relationships. What’s more, digitaland NFT-savvy customer groups will start to enter the metaverse more and more as time goes on. Opportunities to make contact in the new virtual worlds can definitely be relevant for customers like these. Banks can assume the role of establishing a connection between the physical and virtual world that is as seamless as possible by offering banking products to gaming platform operators, for xample. Entertainment is another factor that shouldn’t be underestimated, because bank events could be hosted in the metaverse just like parties or a Snoop Dogg concert.

And what are the risks?

At the end of the day, the key factors are when the technology is mature, the point at which mainstream customers will also start using such opportunities, and how banks can (potentially) operate not only in the regulated real world but also in the metaverse. This involves compliance risks as well. Generally speaking, a question that needs to be answered is whether customers who “do business” in the metaverse will do so via traditional banks – or whether there will then benew providers in the metaversewho are able to offer this type of banking services moreeffectively. There is also a certain “risk” that banking could be merely “embedded” in the metaverse.

“Digital- and NFT-savvy customer groups will start to enter the metaverse more and more as time goes on. New opportunities to make contact in the new virtual worlds can definitely be relevant for customers like these.”– Prof. Dr. Andreas Dietrich

Let’s talk about the digital customer experience: After all, many banks are already offering a solid range of digital services in the form of digital onboarding, online consultations, and co-browsing. So, to what extent can a metaverse branch offer customers additional value beyond this?

Good question. At the moment, the future transition from a mobile banking app to a virtual branch is stillunclear. In which use cases will the customer continuewith the two-dimensional world of the banking app? When will they want to meet a customer adviser in person? And when and why will they use the metaverse, if they in fact do so at all? The metaverse – or a more mature version of it than the one we have today – promises a better customer experience than a twodimensional video call does. But for now, it’s still difficult to say whether it will be suitable not just for parties and concerts but for financial consultations as well.