Digital signature – a Covid phenomenon becomes a universal reality

e-Signature // Thanks to changes in the law, the conditions have been created for digital signatures and electronic expressions of will to be rolled out to the masses. Providers like Swisscom Trust Services deliver the technical service via signature platforms with a user-friendly UX.

The global pandemic has accelerated digitalization and, for many companies, posed enormous challenges (at short notice) such as switching their working model to “remote working”. Employees had to work from home efficiently and effectively with virtually no lead time, ensuring market performance without any reduction in performance or loss of productivity under what were, for most people, fundamentally new conditions. The technical prerequisites for remote work-ing had to be created, meaning most companies had to increase their IT capacities and provide new software (especially for collaborative working and online meetings).

However, finding the technical solutions for employees was only one side of the story. Many procedural challenges remained unsolved. Take, for example, the courts, which had to develop new logistics processes for their files, or HR teams, which had no other option than to work at the office because their personnel files were not digitized. The same problem faces the last mile of digitalization: the expression of will by means of electronic signing of documents. For many companies, going to the PO box and to the office to sign documents remained a reality, even during the strictest phases of the Covid lockdowns.

For many, Covid was the tipping point that led them to consider digital signatures as an option. Digital signatures were already legitimized in law several years ago, meaning that qualified signatures have the highest evidential value in the judicial area of Switzerland (ZertES) and the European Union (eIDAS) and are effectively equivalent to a traditional handwritten signature according to the legal interpretation in both judicial areas.

Digitally expressing one's will requires an official identification document (ID card, passport), online registration and a digital signature platform or digitalized workflows enabling simple creation of an electronic signature.

Various simplifications help electronic signatures achieve a breakthrough

Until recently, Swiss law dictated that for online registrations in practically all market segments, a personal introduction was necessary to record a person’s identity online and fulfill the required conditions for an electronic signature. Early movers were therefore forced to show up in person, e.g. in Swisscom shops.

To minimize personal contacts during Covid, the Federal Council issued a temporary relaxation of the relevant regulations in April 2020 and permitted registration via video identification, even outside of the financial intermediaries (e.g. banks). This significantly reduced the obstacles facing qualified elec-tronic signatures, which subsequently accelerated the trend towards the widespread use of digital expressions of will – with usage doubling or even tripling month on month.

As of March 15, 2022, the Swiss authorities have now updated the relevant technical and administrative regulations regarding electronic signatures. In doing so, the temporary alternatives introduced due to Covid have now been permanently adopted and other highly efficient and convenient online registration methods permitted, such as the new Robo-Ident procedure that was recently launched on the market. Firms and public organizations now have access to a wide palette of tested and audited registration methods, allowing customers or citizens to complete online registrations in minutes.

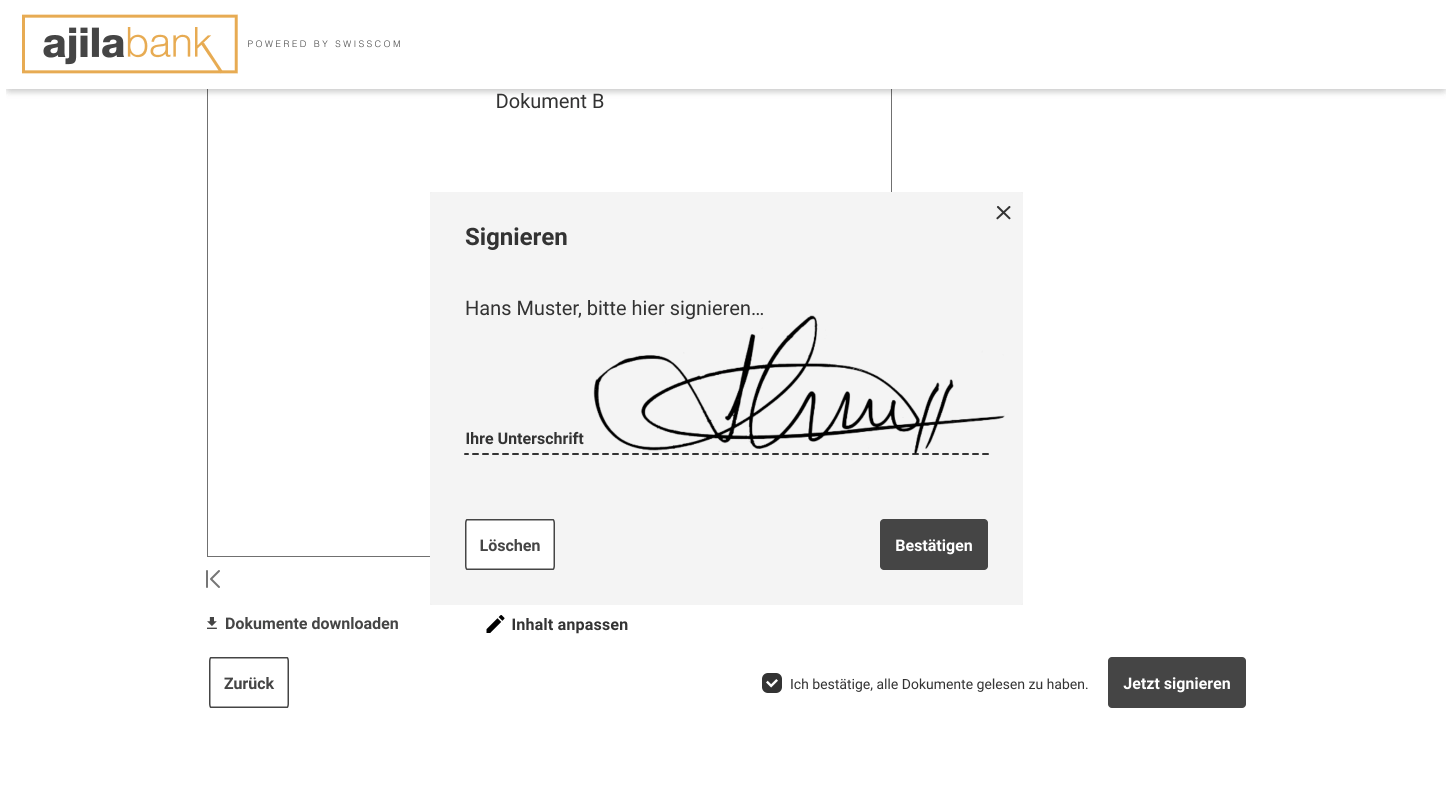

Anyone possessing a verified online iden-tity can now use this to make an electronic expression of will in the digital sphere. In practice, this mostly takes the form of a qualified electronic signature. In order for this to be within the law, various technical and compliance requirements must be observed. That’s where “Trust Service Providers” come in. Swisscom Trust Services is the only European provider offering qualified electronic signatures in the judi-cial areas of the EU (eIDAS Regulation) and Switzerland (ZertES). To ensure wide-spread availability and an optimized UX, these predominantly technical services are delivered via specialized signature platforms - in Switzerland, for instance, Axelity, Blink (Ajila), Skribble, Sysmosoft, Vizibit or Xitrust. User-friendly frontends enable the process of issuing an electronic signature to be carried out without technical know-how. Firms such as Ajila go one step further and digitalize the entire process using forms, which request the signature during one of the process steps. Electronic signatures are also increasingly being made available by being integrated directly into core or support systems.

One thing all the solutions have in common is that they provide easy access to the digital signature and make the process considerably more efficient and seamless – an imperative to win and retain customers in the age of Big Tech and Fintech. As well as improving the completion rate of processes, this also increases security significantly, as the process is traceable and verifiable at all times. Digital signatures also present an important pillar of the collective effort to increase sustainability, constituting yet another important criterion for the widespread provision of electronic signatures. Based on these strong arguments for electronic signatures, it is no wonder that digital signatures come out top in surveys on measures that should remain part of everyday practice and be made even more widely available after the Covid era.

Digitale Signatur als letzte Meile in der Digitalisierung

The global pandemic has accelerated digitalization and, for many companies, posed enormous challenges (at short notice) such as switching their working model to “remote working”. Employees had to work from home efficiently and effectively with virtually no lead time, ensuring market performance without any reduction in performance or loss of productivity under what were, for most people, fundamentally new conditions. The technical prerequisites for remote work-ing had to be created, meaning most companies had to increase their IT capacities and provide new software (especially for collaborative working and online meetings).

However, finding the technical solutions for employees was only one side of the story. Many procedural challenges remained unsolved. Take, for example, the courts, which had to develop new logistics processes for their files, or HR teams, which had no other option than to work at the office because their personnel files were not digitized. The same problem faces the last mile of digitalization: the expression of will by means of electronic signing of documents. For many companies, going to the PO box and to the office to sign documents remained a reality, even during the strictest phases of the Covid lockdowns.

For many, Covid was the tipping point that led them to consider digital signatures as an option. Digital signatures were already legitimized in law several years ago, meaning that qualified signatures have the highest evidential value in the judicial area of Switzerland (ZertES) and the European Union (eIDAS) and are effectively equivalent to a traditional handwritten signature according to the legal interpretation in both judicial areas.

Digitally expressing one's will requires an official identification document (ID card, passport), online registration and a digital signature platform or digitalized workflows enabling simple creation of an electronic signature.

Various simplifications help electronic signatures achieve a breakthrough

Until recently, Swiss law dictated that for online registrations in practically all market segments, a personal introduction was necessary to record a person’s identity online and fulfill the required conditions for an electronic signature. Early movers were therefore forced to show up in person, e.g. in Swisscom shops.

To minimize personal contacts during Covid, the Federal Council issued a temporary relaxation of the relevant regulations in April 2020 and permitted registration via video identification, even outside of the financial intermediaries (e.g. banks). This significantly reduced the obstacles facing qualified elec-tronic signatures, which subsequently accelerated the trend towards the widespread use of digital expressions of will – with usage doubling or even tripling month on month.

As of March 15, 2022, the Swiss authorities have now updated the relevant technical and administrative regulations regarding electronic signatures. In doing so, the temporary alternatives introduced due to Covid have now been permanently adopted and other highly efficient and convenient online registration methods permitted, such as the new Robo-Ident procedure that was recently launched on the market. Firms and public organizations now have access to a wide palette of tested and audited registration methods, allowing customers or citizens to complete online registrations in minutes.

Anyone possessing a verified online iden-tity can now use this to make an electronic expression of will in the digital sphere. In practice, this mostly takes the form of a qualified electronic signature. In order for this to be within the law, various technical and compliance requirements must be observed. That’s where “Trust Service Providers” come in. Swisscom Trust Services is the only European provider offering qualified electronic signatures in the judi-cial areas of the EU (eIDAS Regulation) and Switzerland (ZertES). To ensure wide-spread availability and an optimized UX, these predominantly technical services are delivered via specialized signature platforms - in Switzerland, for instance, Axelity, Blink (Ajila), Skribble, Sysmosoft, Vizibit or Xitrust. User-friendly frontends enable the process of issuing an electronic signature to be carried out without technical know-how. Firms such as Ajila go one step further and digitalize the entire process using forms, which request the signature during one of the process steps. Electronic signatures are also increasingly being made available by being integrated directly into core or support systems.

One thing all the solutions have in common is that they provide easy access to the digital signature and make the process considerably more efficient and seamless – an imperative to win and retain customers in the age of Big Tech and Fintech. As well as improving the completion rate of processes, this also increases security significantly, as the process is traceable and verifiable at all times. Digital signatures also present an important pillar of the collective effort to increase sustainability, constituting yet another important criterion for the widespread provision of electronic signatures. Based on these strong arguments for electronic signatures, it is no wonder that digital signatures come out top in surveys on measures that should remain part of everyday practice and be made even more widely available after the Covid era.

Voraussetzungen der elektronischen Signatur

The global pandemic has accelerated digitalization and, for many companies, posed enormous challenges (at short notice) such as switching their working model to “remote working”. Employees had to work from home efficiently and effectively with virtually no lead time, ensuring market performance without any reduction in performance or loss of productivity under what were, for most people, fundamentally new conditions. The technical prerequisites for remote work-ing had to be created, meaning most companies had to increase their IT capacities and provide new software (especially for collaborative working and online meetings).

However, finding the technical solutions for employees was only one side of the story. Many procedural challenges remained unsolved. Take, for example, the courts, which had to develop new logistics processes for their files, or HR teams, which had no other option than to work at the office because their personnel files were not digitized. The same problem faces the last mile of digitalization: the expression of will by means of electronic signing of documents. For many companies, going to the PO box and to the office to sign documents remained a reality, even during the strictest phases of the Covid lockdowns.

For many, Covid was the tipping point that led them to consider digital signatures as an option. Digital signatures were already legitimized in law several years ago, meaning that qualified signatures have the highest evidential value in the judicial area of Switzerland (ZertES) and the European Union (eIDAS) and are effectively equivalent to a traditional handwritten signature according to the legal interpretation in both judicial areas.

Digitally expressing one's will requires an official identification document (ID card, passport), online registration and a digital signature platform or digitalized workflows enabling simple creation of an electronic signature.

Various simplifications help electronic signatures achieve a breakthrough

Until recently, Swiss law dictated that for online registrations in practically all market segments, a personal introduction was necessary to record a person’s identity online and fulfill the required conditions for an electronic signature. Early movers were therefore forced to show up in person, e.g. in Swisscom shops.

To minimize personal contacts during Covid, the Federal Council issued a temporary relaxation of the relevant regulations in April 2020 and permitted registration via video identification, even outside of the financial intermediaries (e.g. banks). This significantly reduced the obstacles facing qualified elec-tronic signatures, which subsequently accelerated the trend towards the widespread use of digital expressions of will – with usage doubling or even tripling month on month.

As of March 15, 2022, the Swiss authorities have now updated the relevant technical and administrative regulations regarding electronic signatures. In doing so, the temporary alternatives introduced due to Covid have now been permanently adopted and other highly efficient and convenient online registration methods permitted, such as the new Robo-Ident procedure that was recently launched on the market. Firms and public organizations now have access to a wide palette of tested and audited registration methods, allowing customers or citizens to complete online registrations in minutes.

Anyone possessing a verified online iden-tity can now use this to make an electronic expression of will in the digital sphere. In practice, this mostly takes the form of a qualified electronic signature. In order for this to be within the law, various technical and compliance requirements must be observed. That’s where “Trust Service Providers” come in. Swisscom Trust Services is the only European provider offering qualified electronic signatures in the judi-cial areas of the EU (eIDAS Regulation) and Switzerland (ZertES). To ensure wide-spread availability and an optimized UX, these predominantly technical services are delivered via specialized signature platforms - in Switzerland, for instance, Axelity, Blink (Ajila), Skribble, Sysmosoft, Vizibit or Xitrust. User-friendly frontends enable the process of issuing an electronic signature to be carried out without technical know-how. Firms such as Ajila go one step further and digitalize the entire process using forms, which request the signature during one of the process steps. Electronic signatures are also increasingly being made available by being integrated directly into core or support systems.

One thing all the solutions have in common is that they provide easy access to the digital signature and make the process considerably more efficient and seamless – an imperative to win and retain customers in the age of Big Tech and Fintech. As well as improving the completion rate of processes, this also increases security significantly, as the process is traceable and verifiable at all times. Digital signatures also present an important pillar of the collective effort to increase sustainability, constituting yet another important criterion for the widespread provision of electronic signatures. Based on these strong arguments for electronic signatures, it is no wonder that digital signatures come out top in surveys on measures that should remain part of everyday practice and be made even more widely available after the Covid era.

Diverse Vereinfachungen verhelfen der elektronischen Signatur zum Durchbruch

The global pandemic has accelerated digitalization and, for many companies, posed enormous challenges (at short notice) such as switching their working model to “remote working”. Employees had to work from home efficiently and effectively with virtually no lead time, ensuring market performance without any reduction in performance or loss of productivity under what were, for most people, fundamentally new conditions. The technical prerequisites for remote work-ing had to be created, meaning most companies had to increase their IT capacities and provide new software (especially for collaborative working and online meetings).

However, finding the technical solutions for employees was only one side of the story. Many procedural challenges remained unsolved. Take, for example, the courts, which had to develop new logistics processes for their files, or HR teams, which had no other option than to work at the office because their personnel files were not digitized. The same problem faces the last mile of digitalization: the expression of will by means of electronic signing of documents. For many companies, going to the PO box and to the office to sign documents remained a reality, even during the strictest phases of the Covid lockdowns.

For many, Covid was the tipping point that led them to consider digital signatures as an option. Digital signatures were already legitimized in law several years ago, meaning that qualified signatures have the highest evidential value in the judicial area of Switzerland (ZertES) and the European Union (eIDAS) and are effectively equivalent to a traditional handwritten signature according to the legal interpretation in both judicial areas.

Digitally expressing one's will requires an official identification document (ID card, passport), online registration and a digital signature platform or digitalized workflows enabling simple creation of an electronic signature.

Various simplifications help electronic signatures achieve a breakthrough

Until recently, Swiss law dictated that for online registrations in practically all market segments, a personal introduction was necessary to record a person’s identity online and fulfill the required conditions for an electronic signature. Early movers were therefore forced to show up in person, e.g. in Swisscom shops.

To minimize personal contacts during Covid, the Federal Council issued a temporary relaxation of the relevant regulations in April 2020 and permitted registration via video identification, even outside of the financial intermediaries (e.g. banks). This significantly reduced the obstacles facing qualified elec-tronic signatures, which subsequently accelerated the trend towards the widespread use of digital expressions of will – with usage doubling or even tripling month on month.

As of March 15, 2022, the Swiss authorities have now updated the relevant technical and administrative regulations regarding electronic signatures. In doing so, the temporary alternatives introduced due to Covid have now been permanently adopted and other highly efficient and convenient online registration methods permitted, such as the new Robo-Ident procedure that was recently launched on the market. Firms and public organizations now have access to a wide palette of tested and audited registration methods, allowing customers or citizens to complete online registrations in minutes.

Anyone possessing a verified online iden-tity can now use this to make an electronic expression of will in the digital sphere. In practice, this mostly takes the form of a qualified electronic signature. In order for this to be within the law, various technical and compliance requirements must be observed. That’s where “Trust Service Providers” come in. Swisscom Trust Services is the only European provider offering qualified electronic signatures in the judi-cial areas of the EU (eIDAS Regulation) and Switzerland (ZertES). To ensure wide-spread availability and an optimized UX, these predominantly technical services are delivered via specialized signature platforms - in Switzerland, for instance, Axelity, Blink (Ajila), Skribble, Sysmosoft, Vizibit or Xitrust. User-friendly frontends enable the process of issuing an electronic signature to be carried out without technical know-how. Firms such as Ajila go one step further and digitalize the entire process using forms, which request the signature during one of the process steps. Electronic signatures are also increasingly being made available by being integrated directly into core or support systems.

One thing all the solutions have in common is that they provide easy access to the digital signature and make the process considerably more efficient and seamless – an imperative to win and retain customers in the age of Big Tech and Fintech. As well as improving the completion rate of processes, this also increases security significantly, as the process is traceable and verifiable at all times. Digital signatures also present an important pillar of the collective effort to increase sustainability, constituting yet another important criterion for the widespread provision of electronic signatures. Based on these strong arguments for electronic signatures, it is no wonder that digital signatures come out top in surveys on measures that should remain part of everyday practice and be made even more widely available after the Covid era.

Rechtssicherheit digitaler Signaturen dank Trust Service Providern

The global pandemic has accelerated digitalization and, for many companies, posed enormous challenges (at short notice) such as switching their working model to “remote working”. Employees had to work from home efficiently and effectively with virtually no lead time, ensuring market performance without any reduction in performance or loss of productivity under what were, for most people, fundamentally new conditions. The technical prerequisites for remote work-ing had to be created, meaning most companies had to increase their IT capacities and provide new software (especially for collaborative working and online meetings).

However, finding the technical solutions for employees was only one side of the story. Many procedural challenges remained unsolved. Take, for example, the courts, which had to develop new logistics processes for their files, or HR teams, which had no other option than to work at the office because their personnel files were not digitized. The same problem faces the last mile of digitalization: the expression of will by means of electronic signing of documents. For many companies, going to the PO box and to the office to sign documents remained a reality, even during the strictest phases of the Covid lockdowns.

For many, Covid was the tipping point that led them to consider digital signatures as an option. Digital signatures were already legitimized in law several years ago, meaning that qualified signatures have the highest evidential value in the judicial area of Switzerland (ZertES) and the European Union (eIDAS) and are effectively equivalent to a traditional handwritten signature according to the legal interpretation in both judicial areas.

Digitally expressing one's will requires an official identification document (ID card, passport), online registration and a digital signature platform or digitalized workflows enabling simple creation of an electronic signature.

Various simplifications help electronic signatures achieve a breakthrough

Until recently, Swiss law dictated that for online registrations in practically all market segments, a personal introduction was necessary to record a person’s identity online and fulfill the required conditions for an electronic signature. Early movers were therefore forced to show up in person, e.g. in Swisscom shops.

To minimize personal contacts during Covid, the Federal Council issued a temporary relaxation of the relevant regulations in April 2020 and permitted registration via video identification, even outside of the financial intermediaries (e.g. banks). This significantly reduced the obstacles facing qualified elec-tronic signatures, which subsequently accelerated the trend towards the widespread use of digital expressions of will – with usage doubling or even tripling month on month.

As of March 15, 2022, the Swiss authorities have now updated the relevant technical and administrative regulations regarding electronic signatures. In doing so, the temporary alternatives introduced due to Covid have now been permanently adopted and other highly efficient and convenient online registration methods permitted, such as the new Robo-Ident procedure that was recently launched on the market. Firms and public organizations now have access to a wide palette of tested and audited registration methods, allowing customers or citizens to complete online registrations in minutes.

Anyone possessing a verified online iden-tity can now use this to make an electronic expression of will in the digital sphere. In practice, this mostly takes the form of a qualified electronic signature. In order for this to be within the law, various technical and compliance requirements must be observed. That’s where “Trust Service Providers” come in. Swisscom Trust Services is the only European provider offering qualified electronic signatures in the judi-cial areas of the EU (eIDAS Regulation) and Switzerland (ZertES). To ensure wide-spread availability and an optimized UX, these predominantly technical services are delivered via specialized signature platforms - in Switzerland, for instance, Axelity, Blink (Ajila), Skribble, Sysmosoft, Vizibit or Xitrust. User-friendly frontends enable the process of issuing an electronic signature to be carried out without technical know-how. Firms such as Ajila go one step further and digitalize the entire process using forms, which request the signature during one of the process steps. Electronic signatures are also increasingly being made available by being integrated directly into core or support systems.

One thing all the solutions have in common is that they provide easy access to the digital signature and make the process considerably more efficient and seamless – an imperative to win and retain customers in the age of Big Tech and Fintech. As well as improving the completion rate of processes, this also increases security significantly, as the process is traceable and verifiable at all times. Digital signatures also present an important pillar of the collective effort to increase sustainability, constituting yet another important criterion for the widespread provision of electronic signatures. Based on these strong arguments for electronic signatures, it is no wonder that digital signatures come out top in surveys on measures that should remain part of everyday practice and be made even more widely available after the Covid era.

Ein einfacher Zugang zur digitalen Signatur?

The global pandemic has accelerated digitalization and, for many companies, posed enormous challenges (at short notice) such as switching their working model to “remote working”. Employees had to work from home efficiently and effectively with virtually no lead time, ensuring market performance without any reduction in performance or loss of productivity under what were, for most people, fundamentally new conditions. The technical prerequisites for remote work-ing had to be created, meaning most companies had to increase their IT capacities and provide new software (especially for collaborative working and online meetings).

However, finding the technical solutions for employees was only one side of the story. Many procedural challenges remained unsolved. Take, for example, the courts, which had to develop new logistics processes for their files, or HR teams, which had no other option than to work at the office because their personnel files were not digitized. The same problem faces the last mile of digitalization: the expression of will by means of electronic signing of documents. For many companies, going to the PO box and to the office to sign documents remained a reality, even during the strictest phases of the Covid lockdowns.

For many, Covid was the tipping point that led them to consider digital signatures as an option. Digital signatures were already legitimized in law several years ago, meaning that qualified signatures have the highest evidential value in the judicial area of Switzerland (ZertES) and the European Union (eIDAS) and are effectively equivalent to a traditional handwritten signature according to the legal interpretation in both judicial areas.

Digitally expressing one's will requires an official identification document (ID card, passport), online registration and a digital signature platform or digitalized workflows enabling simple creation of an electronic signature.

Various simplifications help electronic signatures achieve a breakthrough

Until recently, Swiss law dictated that for online registrations in practically all market segments, a personal introduction was necessary to record a person’s identity online and fulfill the required conditions for an electronic signature. Early movers were therefore forced to show up in person, e.g. in Swisscom shops.

To minimize personal contacts during Covid, the Federal Council issued a temporary relaxation of the relevant regulations in April 2020 and permitted registration via video identification, even outside of the financial intermediaries (e.g. banks). This significantly reduced the obstacles facing qualified elec-tronic signatures, which subsequently accelerated the trend towards the widespread use of digital expressions of will – with usage doubling or even tripling month on month.

As of March 15, 2022, the Swiss authorities have now updated the relevant technical and administrative regulations regarding electronic signatures. In doing so, the temporary alternatives introduced due to Covid have now been permanently adopted and other highly efficient and convenient online registration methods permitted, such as the new Robo-Ident procedure that was recently launched on the market. Firms and public organizations now have access to a wide palette of tested and audited registration methods, allowing customers or citizens to complete online registrations in minutes.

Anyone possessing a verified online iden-tity can now use this to make an electronic expression of will in the digital sphere. In practice, this mostly takes the form of a qualified electronic signature. In order for this to be within the law, various technical and compliance requirements must be observed. That’s where “Trust Service Providers” come in. Swisscom Trust Services is the only European provider offering qualified electronic signatures in the judi-cial areas of the EU (eIDAS Regulation) and Switzerland (ZertES). To ensure wide-spread availability and an optimized UX, these predominantly technical services are delivered via specialized signature platforms - in Switzerland, for instance, Axelity, Blink (Ajila), Skribble, Sysmosoft, Vizibit or Xitrust. User-friendly frontends enable the process of issuing an electronic signature to be carried out without technical know-how. Firms such as Ajila go one step further and digitalize the entire process using forms, which request the signature during one of the process steps. Electronic signatures are also increasingly being made available by being integrated directly into core or support systems.

One thing all the solutions have in common is that they provide easy access to the digital signature and make the process considerably more efficient and seamless – an imperative to win and retain customers in the age of Big Tech and Fintech. As well as improving the completion rate of processes, this also increases security significantly, as the process is traceable and verifiable at all times. Digital signatures also present an important pillar of the collective effort to increase sustainability, constituting yet another important criterion for the widespread provision of electronic signatures. Based on these strong arguments for electronic signatures, it is no wonder that digital signatures come out top in surveys on measures that should remain part of everyday practice and be made even more widely available after the Covid era.