Baloise Bank AG

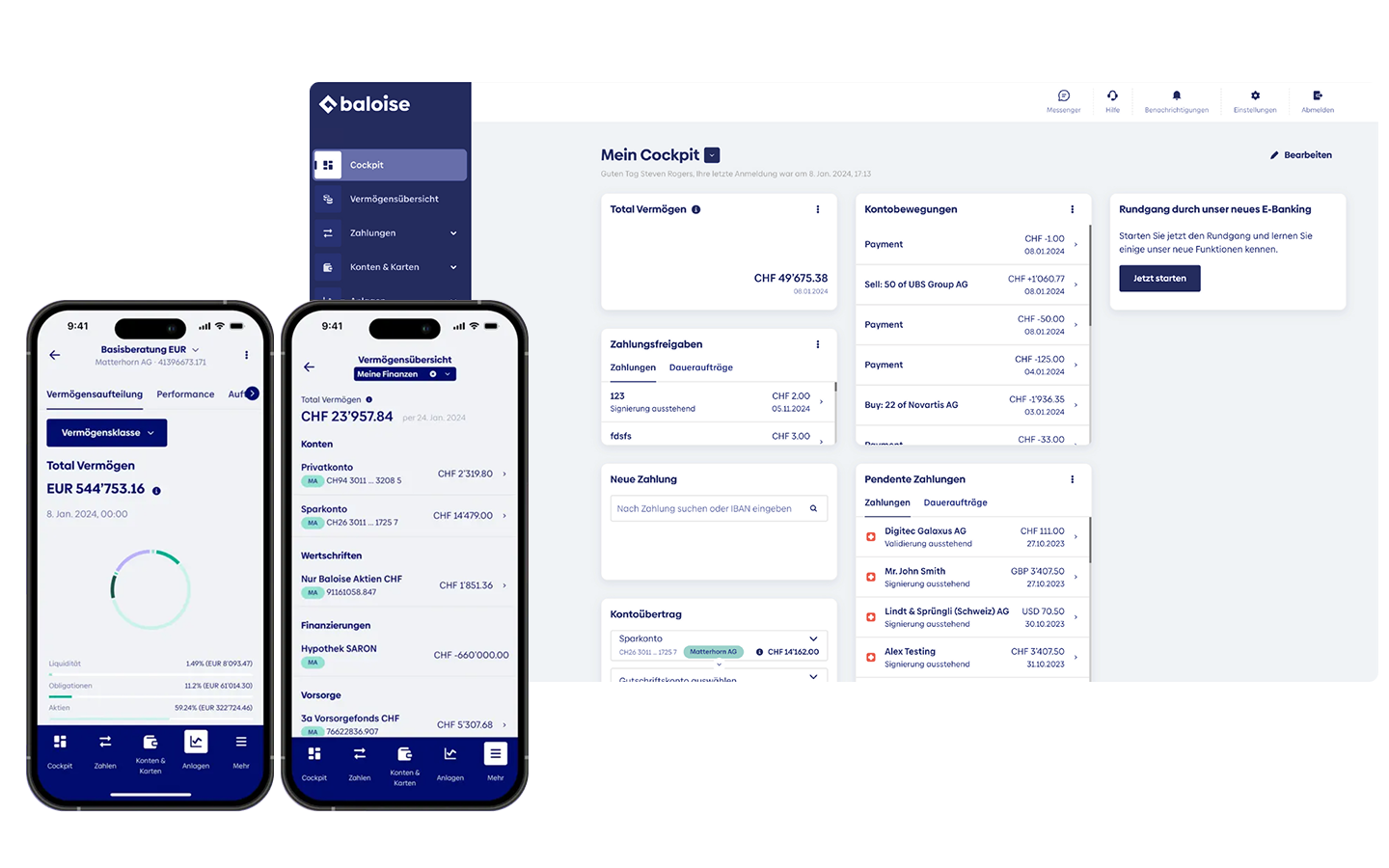

A new mobile and e-banking solution in record time

How ti&m replaced Baloise’s mobile and e-banking solution with ti&m Banking in just 16 months.

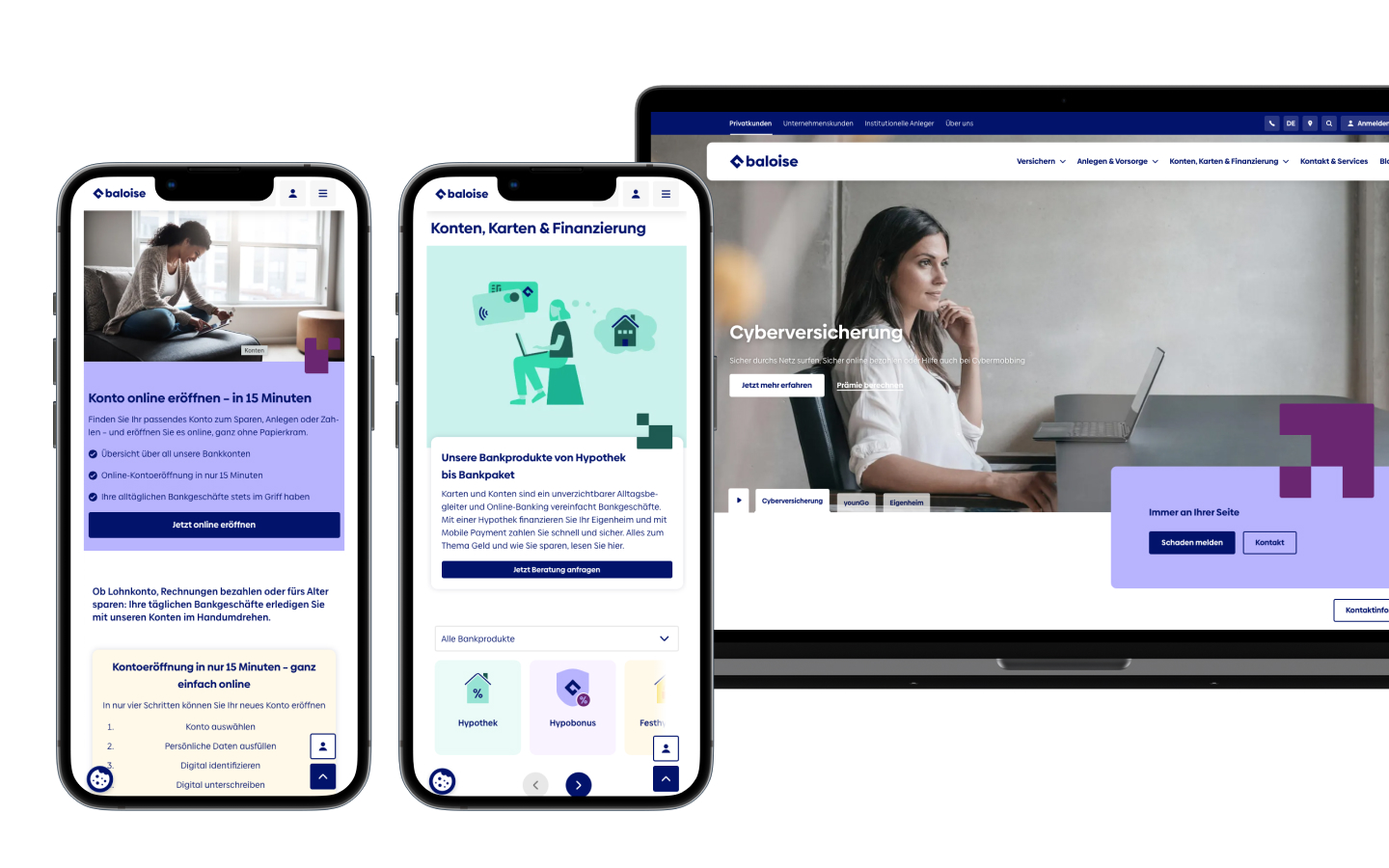

We implemented a customer-friendly and future-proof banking solution for Baloise with a new mobile and e-banking system based on ti&m Banking. The open architecture provides the foundations for combining Baloise’s partner offerings and insurance products into a single customer portal down the line. ti&m Banking was integrated into the existing application landscape and the Avaloq core banking system within 16 months, and the 50,000 customers were migrated in four waves.

Why was a new mobile and e-banking solution needed?

The old banking solution no longer met the requirements for implementing Baloise’s future digitalization strategy. Implementing releases and developing new functions was time-consuming and complicated. Baloise wanted a new solution with a modular, open architecture that would enable faster release cycles and the long-term development of its digital offering through the simple integration of third-party systems. The bank did not want to develop a custom solution to suit its requirements, and instead opted for the tried-and-tested ti&m Banking product solution, which can be expanded and adapted with little effort as required in future.

“We were under a lot of time pressure because the go-live date was fixed and couldn’t be postponed. The excellent collaboration with ti&m and the willingness of everyone involved to go the extra mile were crucial to achieving success.”– Roger Sutter, Digital Officer at Baloise Bank AG

Timing

The biggest challenge? The tight time frame

Performance

Modularity for better performance and more efficient releases

“What impressed us about ti&m was the high level of usability, the good collaboration, and the comprehensive coverage of our requirements, especially with regard to future expansions. The chemistry was perfect, even in the initial test projects, and this positivity continued throughout the project. I would particularly like to emphasize the commitment, technological expertise, openness, and positive cooperation with ti&m.”– Roger Sutter, Digital Officer at Baloise Bank AG

Head Banking Innovations

Roger Zuberbühler

Are you ready to transform your bank with cutting-edge technology?