ti&m Onboarding for OKB

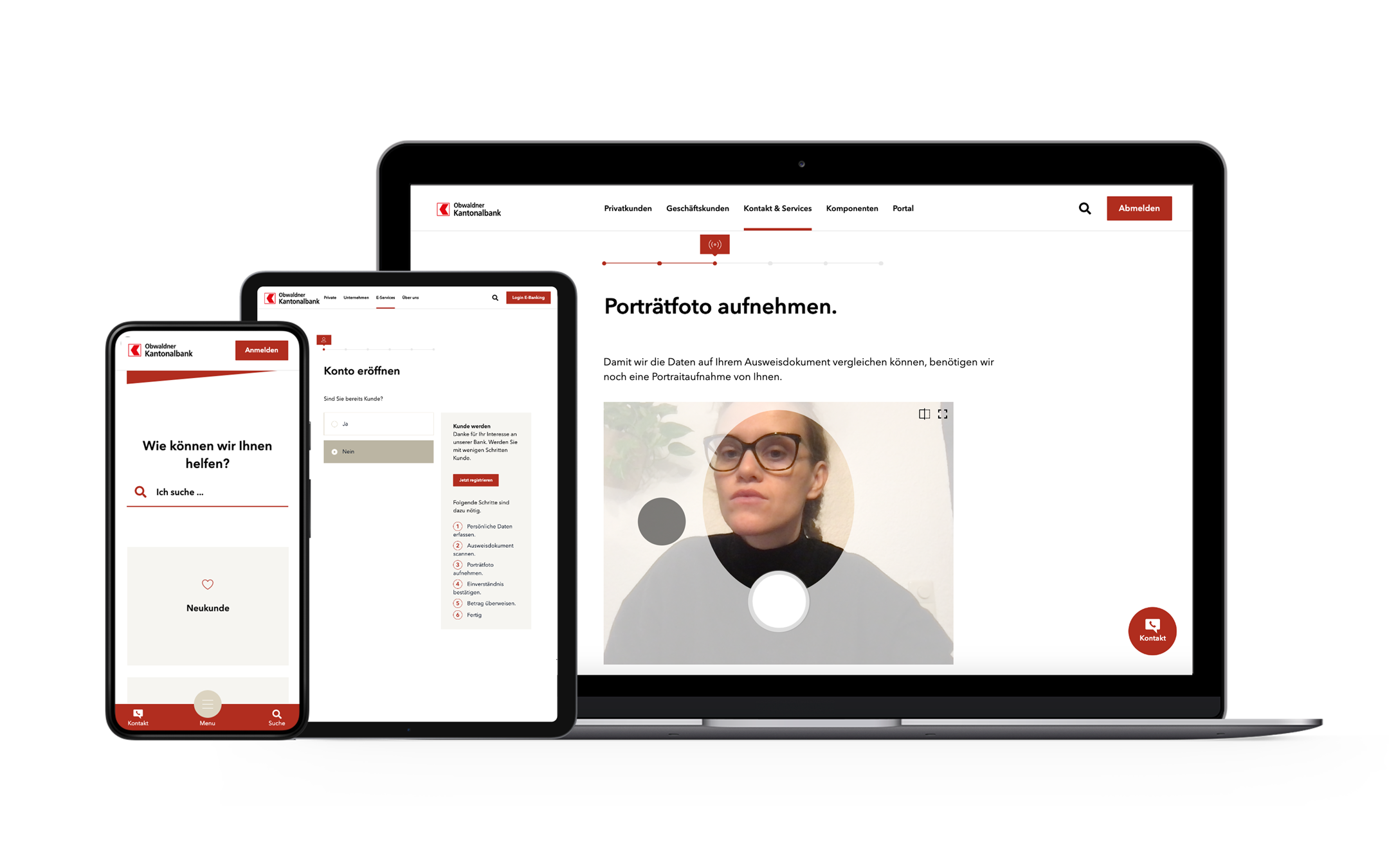

Digital onboarding for retail customers

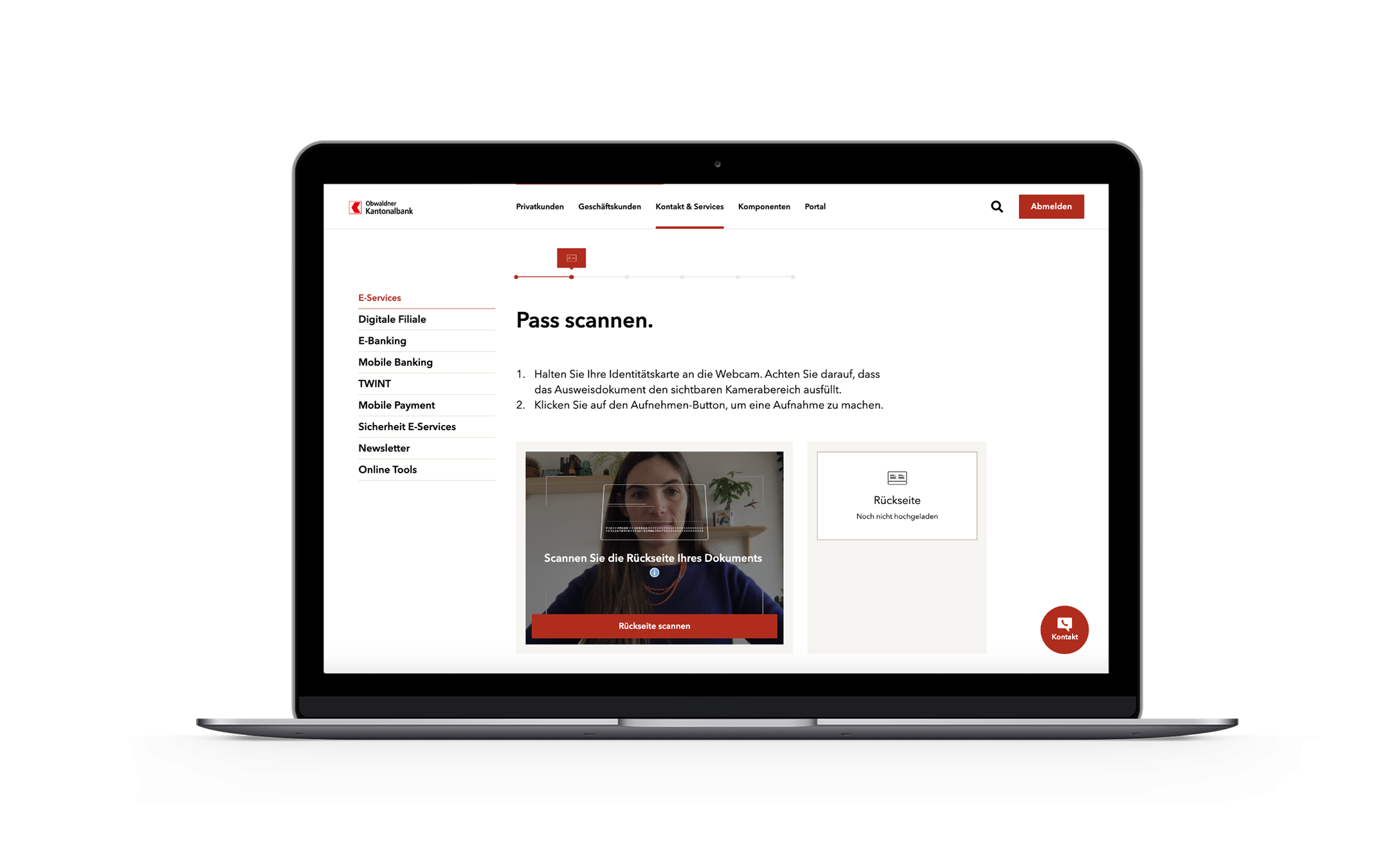

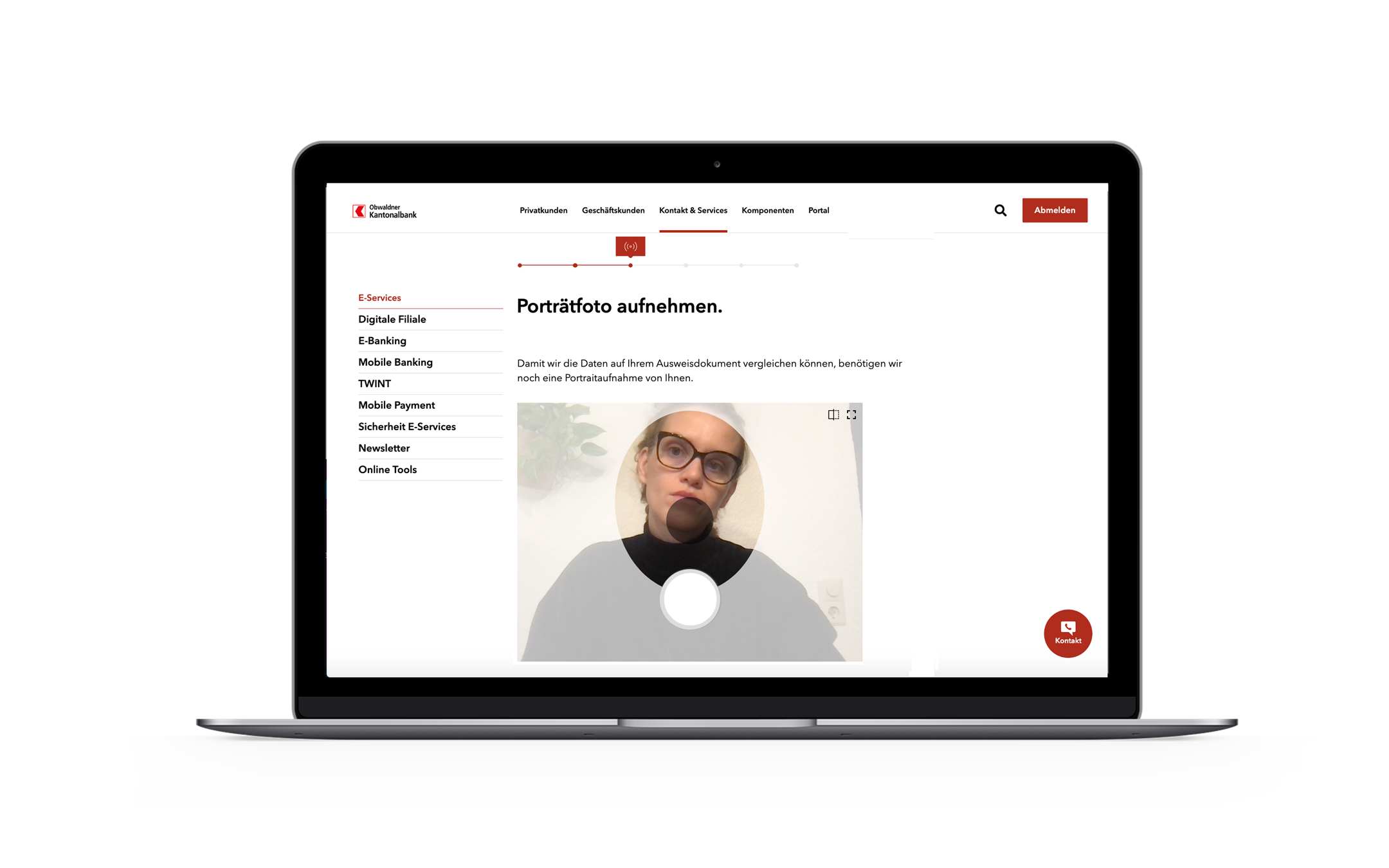

As part of the Finnova Portal as a Service project, a collaboration between Finnova and ti&m, ti&m online identification was introduced at Obwaldner Kantonalbank.

Our fully automated self-service onboarding makes it easy for new customers to open a bank account whether they’re at home or on the road: any time, fully automatic and FINMA-compliant!

Working with our partner Finnova, we implemented a new portal solution (PaaS) for the OKB. Part of the project was to integrate digital, fully automated onboarding based on ti&m’s online identification process. This allows potential customers to open a private account at any time of day or night. Our onboarding is seamlessly integrated into OKB’s core banking system, and customer data is always up to date. The components of the portal solution and the onboarding solution come from the two product ranges: ti&m Banking and ti&m Onboarding.

Their simple and direct communication and their willingness to react agilely to new situations at any time has made working with ti&m very easy and enjoyable.– Dominic Wolf, Head of Multichannel

Award-winning, patented solution

The ti&m Onboarding was recognized in the Business Impact and Enterprise categories of the Best of Swiss Apps 2021 awards.

The ti&m Onboarding identification process has also been patented by the Swiss Federal Institute of Intellectual Property.

Features

01

Compliance

The fully automated process is FINMA-compliant and meets all legal requirements

02

AI

Artificial intelligence allows the system to detect identification documents even under difficult conditions such as poor lighting

03

Core banking system

Customer information is stored directly in the existing banking system

04

PaaS

The process is available to all banks as a service, and can be easily and quickly integrated into individual systems environments

Head Banking Innovations

Roger Zuberbühler

Want to know more about the leading Swiss onboarding process?