The holistic advisory solution from ti&m

ti&m advisory suite // There are several advisory solutions aimed at specific financial concerns. With the ti&m advisory suite, ti&m and twentysecond have developed an advisory solution for retail banks that bundles all these concerns in one central platform. This allows advisors to holistically advise their customers, while offering an attractive customer journey.

Studies and our day-to-day contact with banks show that advisory services are changing and will have to meet a variety of requirements in the future:

1. Content: Advising clients is becoming more demanding

Clients expect their financial situation to be viewed from a holistic perspective and to be shown how relevant topics from the areas of investment, retirement planning and financing influence each other. This also includes integrating products and services from other financial service providers.

2. Form: The way in which advice is provided is changing

According to the ti&m trend study Banks 2021, only around 15 percent of clients today are pure branch clients — and this figure is declining. Hybrid advisory solutions, self-service or advice at a distance via video or co-browsing are becoming more important.

3. Automation: Countering competitive and profit-margin pressures with increased efficiency

Automated end-to-end processes and the integration of all relevant systems reduce costs and free up resources.

New approaches to advisory services must focus on clients and their current needs — not on the bank’s products and services. In their interactions with clients, advisors should focus entirely on the actual advice they provide in order to reinforce clients’ long-term trust in the bank by using their professional, social, and methodological skills. And advisory services must be compatible with all channels: The various advisory elements must be digitally supported, and contact between client and advisor must be possible via various channels. To streamline back-office processes, relevant information and data should only have to be recorded once, be available at all times, and be automatically migrated into the core banking system. This allows for more efficient pre- and post-processing, and more effective placement of additional products and services. Regardless of the channel, the entire process must be intuitive and attractive, providing a compelling client experience. After all, why shouldn’t advise from a bank be enjoyable?

ti&m advisory suite: Great user experience for a unique client experience

With these requirements in mind and the vision of developing the best advisory solution in Switzerland, ti&m and the advisory-solution experts at twentysecond developed the prototype of such an advisory tool. In this, we combine technology with emotions to offer both client advisors and clients a tool that inspires.

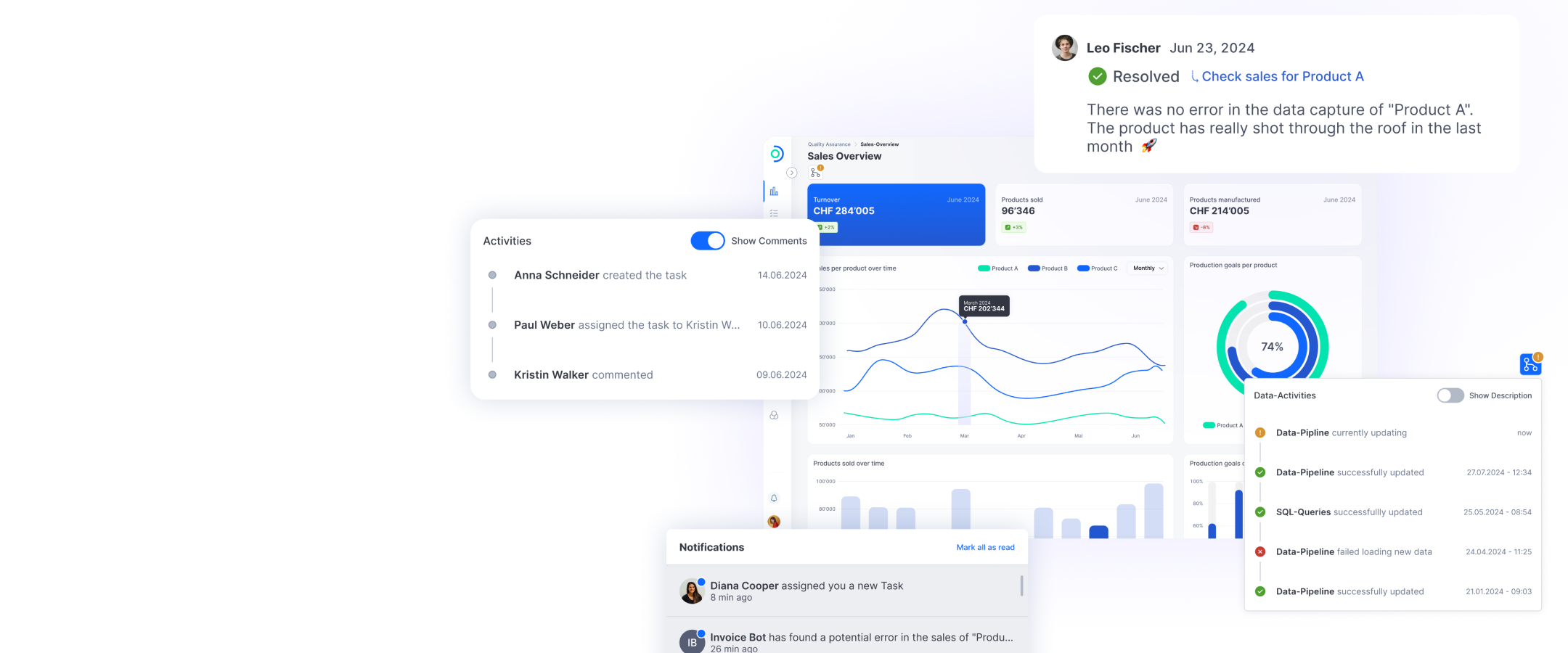

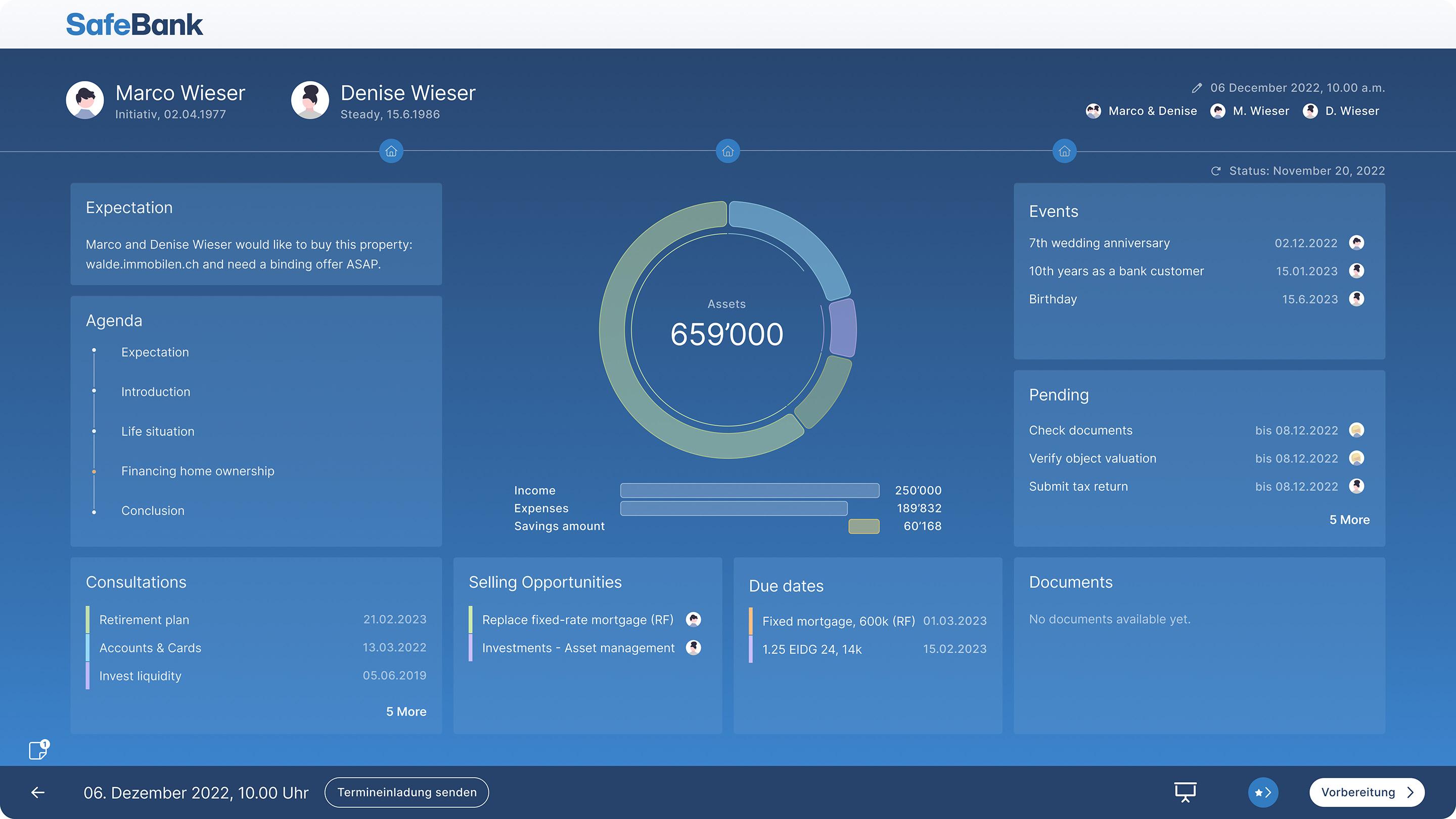

ti&m advisory suite: Dashboard

ti&m advisory suite: Dashboard

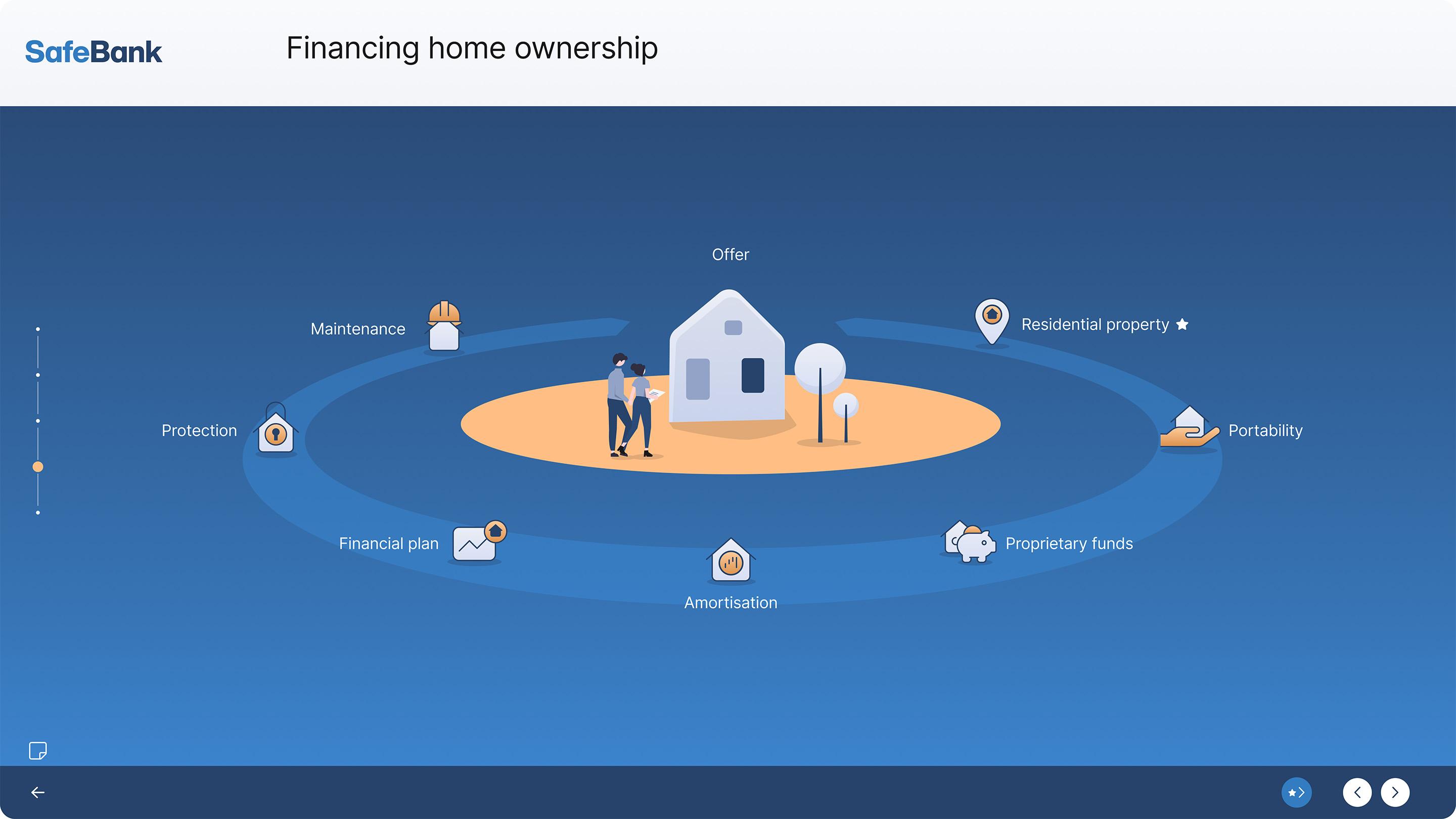

ti&m advisory suite: Customer Journey

ti&m advisory suite: Customer Journey

The advisory process consists of three steps:

Preparation: The advisor launches the advisory suite and creates a new consultation for a bank client. The advisor selects one or more topics to be discussed — in our example, the purchase and financing of a property — and immediately sets up a meeting date using the Outlook integration. All existing information — the entire portfolio of securities, accounts, and pensions together with the client’s personal data — is fed into the dashboard (see Fig. 1) from the core banking system, CRM, or other systems, and displayed in a clear interface for the advisor. In the preparation mode, the advisor can simulate the upcoming meeting and fill out the agenda with the client's previously communicated expectations. The advisor can switch between different client bases to show not only the financial situation of the couple during the advisory meeting, but also the individual situation of each person. The advisor then switches to the process for own-home financing (see Fig. 2). Information can be added to the various elements, such as “Residential property” or

“Affordability”. This information might be the address, the purchase price, or even pictures for the “Residential property” element. The open architecture of the solution means that clients can store information and documents in e-banking for themselves via self-service, and these can then be imported by the advisor. By attaching notes, the advisor can record important points in all elements, so that they can be addressed during the advisory meeting. This concludes the preparation.

Advisory meeting: Before the meeting, advisors can remind themselves of the key information with a glance at the dashboard, and so prepare themselves in a targeted way. At the beginning of the advisory meeting, the client is given an overview of the process and the points to be covered during the meeting. New topics can be added during the meeting and marked for further discussions. Information such as third-party accounts with other banks, which the advisor only learns about during the meeting, can also be quickly recorded in the system. When recording income and expenses, federal statistical values are automatically loaded, and these can then be fine tuned and overwritten during the meeting. During the actual home-financing discussion, the advisor goes through the journey of the “Financing home ownership" module with the client, from “Property” through “Affordability” to “Financing plan”. Here, too, the open architecture offers an engaging client experience: For example, the “Residential property” element can also display information from third parties such as Google Street View or Wüest Partner to show the location of the property including schools or shopping and sports facilities. The advisor guides the client through the entire process until the goal of the discussion — in this case the financing plan for the real estate — is achieved. The last step is the conclusion of the meeting, which is intended to create commitment: Together, the advisor and the client review the pending issues, define the next steps, and arrange the next meeting date in the tool. In addition, a documentation of the advisory meeting can be created and either given directly to the client or made available to him/her in the e-banking system. Pending issues from the meeting can also be displayed to the client in e-banking. The service concludes with feedback from the customer to ensure that it is meeting expectations.

Post-processing: With advisory suite, all document-heavy, time-consuming post-processing is eliminated. The advisor can forward currently pending issues internally to assistants or specialists with a click of the mouse and close the process. On closing, all the newly recorded data is transferred to the core banking system.

Modular, integrated, and holistic

In common with our other product suites — ti&m digital banking suite and ti&m onboarding suite — the ti&m advisory suite is based on ti&m’s tried-and-tested architecture. The architecture is open by design and makes it possible to integrate third-party systems into the back and front ends. The generically used domain model decouples the advisory solution from the core banking system, thereby increasing independence and design freedom to integrate the platform into other systems.