ti&m Online Identification

Building trust with digital identity verification

Build trust between you and your customers with effortless identity verification. ti&m Online Identification lets you quickly and easily verify identities, prevent fraud, and meet compliance standards – all while creating a secure and effortless experience. Build the foundation for strong relationships and business growth.

ti&m Online Identification: enabling trust for you and your customers

ti&m Online Identification connects people and companies through trust. With our solution, the verification process becomes an invisible assistant that breaks down barriers and creates security. Whether concluding a contract, opening an account or using digital signatures – ti&m Online Identification makes secure interactions simple, fast and reliable. Place your trust in a solution that not only protects, but also connects.

What you can achieve with ti&m Online Identification

High success rate

Increase success rate with asynchronous checking

Age verification

Verify age in the blink of an eye

Process design

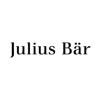

Design your individual onboarding process

ti&m Online Identification

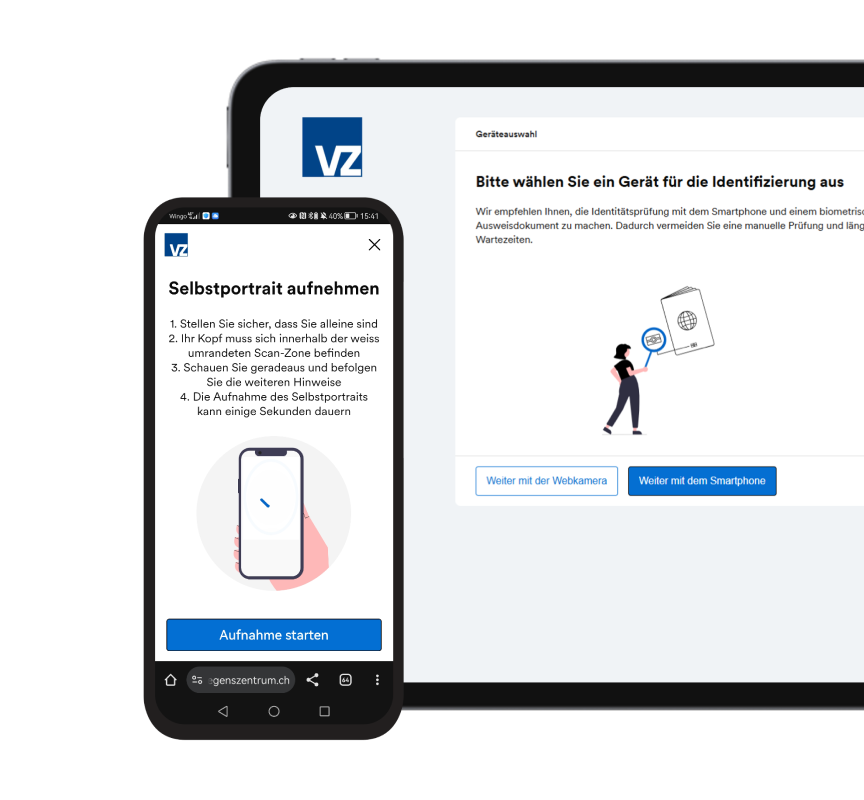

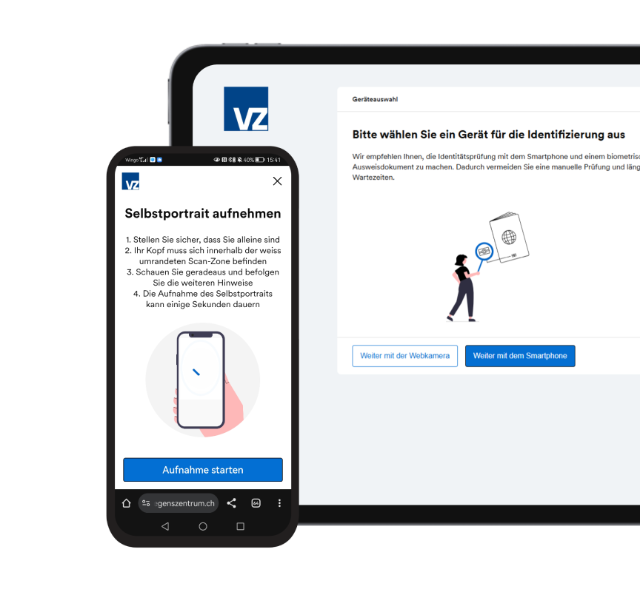

VZ Depotbank

We implemented ti&m Online Identification at VZ Custodian Bank and integrated it with third-party systems, including the core banking system—fully FINMA-compliant, seamless, and user-friendly. New clients can complete their identification and registration entirely digitally, while existing clients can use the same platform to open additional products, such as savings accounts, Pillar 3a accounts, or vested benefits accounts.

Digital Client Onboarding with ti&m Online Identification

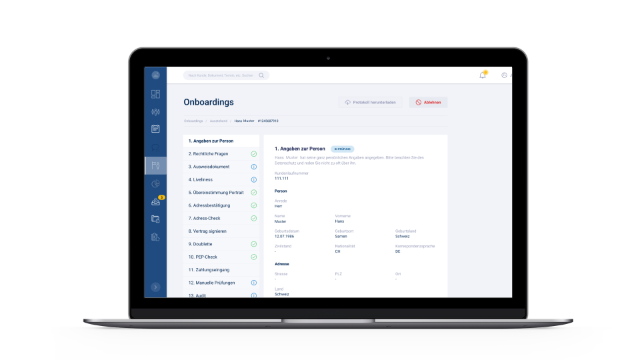

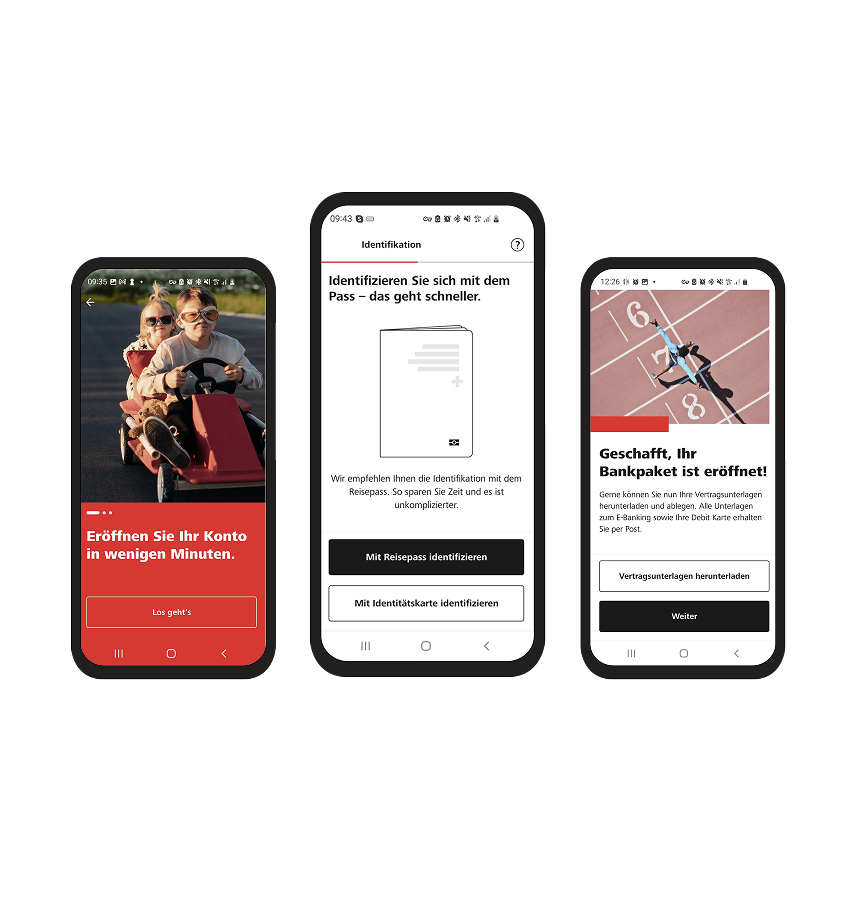

Raiffeisen

Raiffeisen wanted to offer its customers the opportunity to open an account online independently. To this end, Raiffeisen provided them with a mobile app featuring ti&m Online Identification and an integration into the Raiffeisen processes, starting from August 2023. As part of the onboarding process, customers can identify themselves and digitally sign documents.

Comprehensive Verification of Identity Documents

User experience

A full design team is available as needed to help you improve your onboarding journey end to end.

Global coverage

Our system supports the verification of documents from over 40 countries, to increase your chances of success.

MRZ and VIZ

Go beyond photographs – our system is able to read a document through the Machine Readable Zone (MRZ) as well as the Visual Inspection Zone (VIZ).

Hologram check

ti&m Online Identification detects the holograms of a document as an additional security measure.

Forged liveness detection

Our system is able to detect if a person is live in front of the camera.

NFC

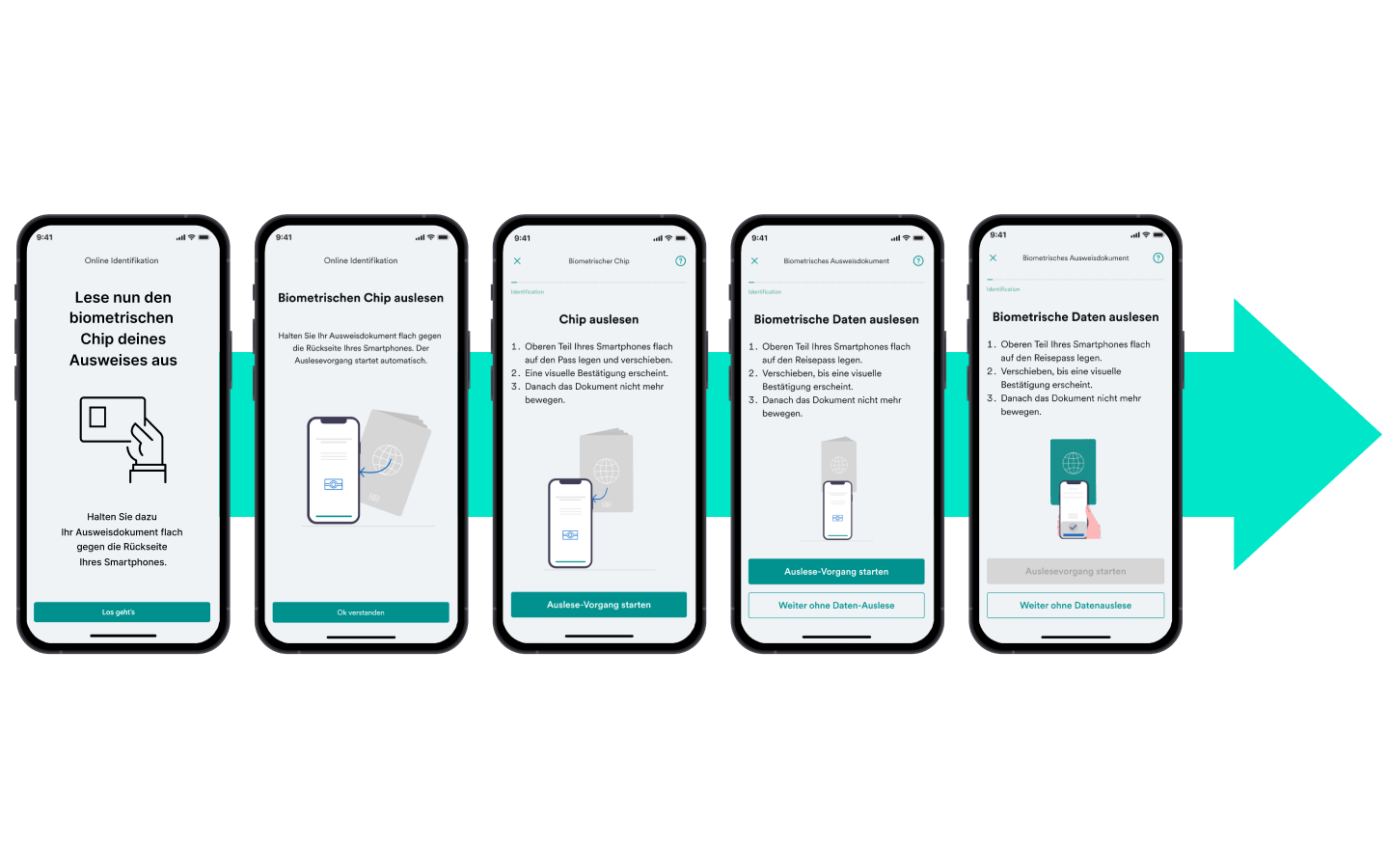

Further improve security by employing near-field communication (NFC) technology when supported by the document.

Discover ti&m Online Identification

Head Banking Innovations

Roger Zuberbühler

Like the sound of fully automated customer onboarding? I’d love to show you a demo of our online identification app.