Digital banking overview

Digital banking software products

Transform your digital banking offering with our modular banking software.

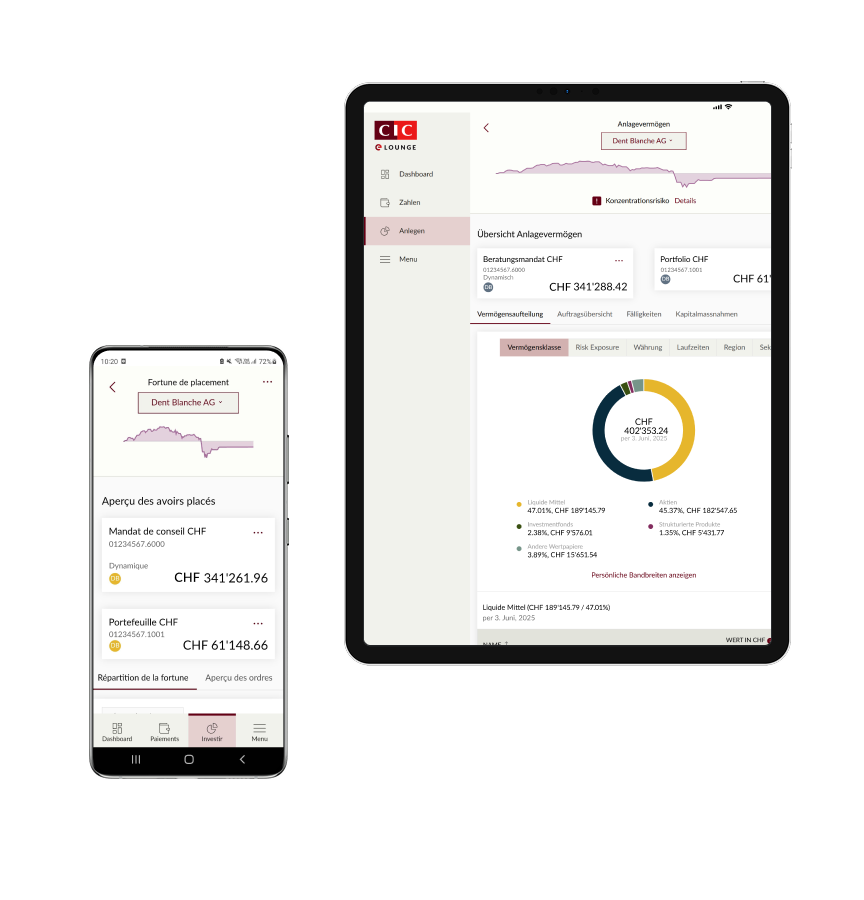

A flexible and personalized online banking experience

The modular setup of our ti&m Banking software allows you to adapt your services flexibly and efficiently to the needs of your customers. Create an enhanced user experience at every touchpoint. We combine our expertise and highly scalable technology with a customer-friendly and appealing design. Discover our digital banking software products in detail.

The core modules of our digital banking software products

Future-proof banking software trusted by leading financial institutions

The strengths of our digital banking products

Seamless experience

Modular banking anywhere and on any device.

Leading technology

Superior technology as the basis for open innovation.

Hollistic design

Serve the entire value chain.

Developed by experts

High level of expertise in banking projects.

Discover ti&m Banking

Our success stories

Many banks are already using ti&m's software products.

Success Story

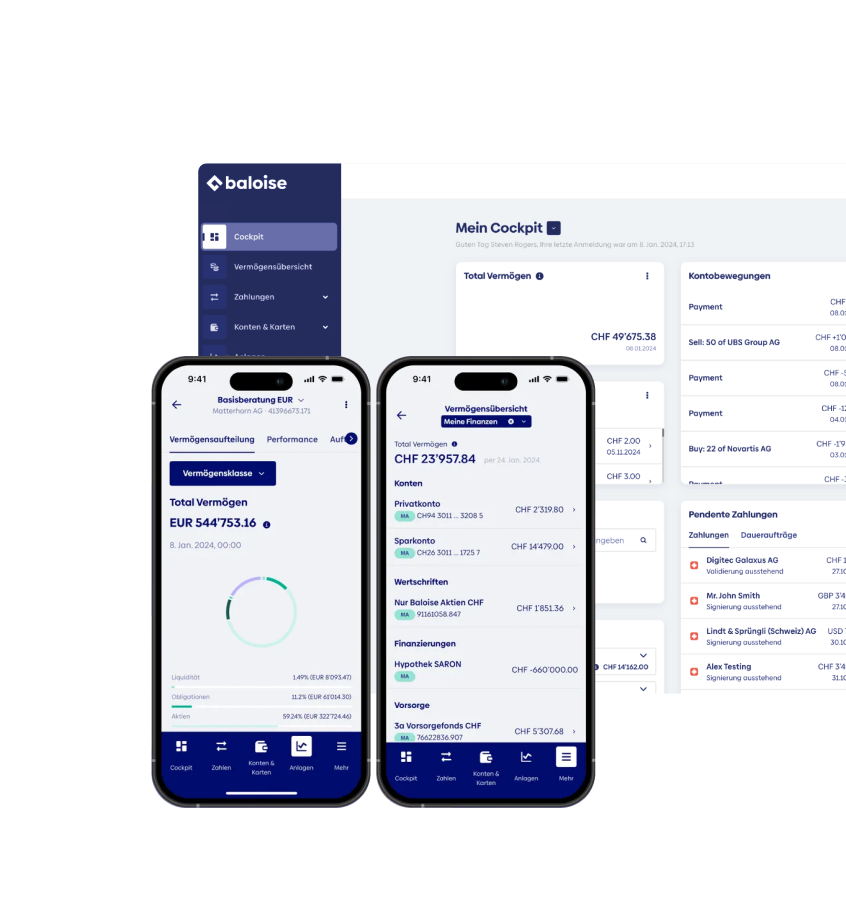

Baloise Bank AG

In just 16 months, we implemented a new mobile and e-banking platform for Baloise based on ti&m Banking. The modular solution was seamlessly integrated into the Avaloq core banking system, enables faster release cycles, and lays the foundation for future digitalization projects.

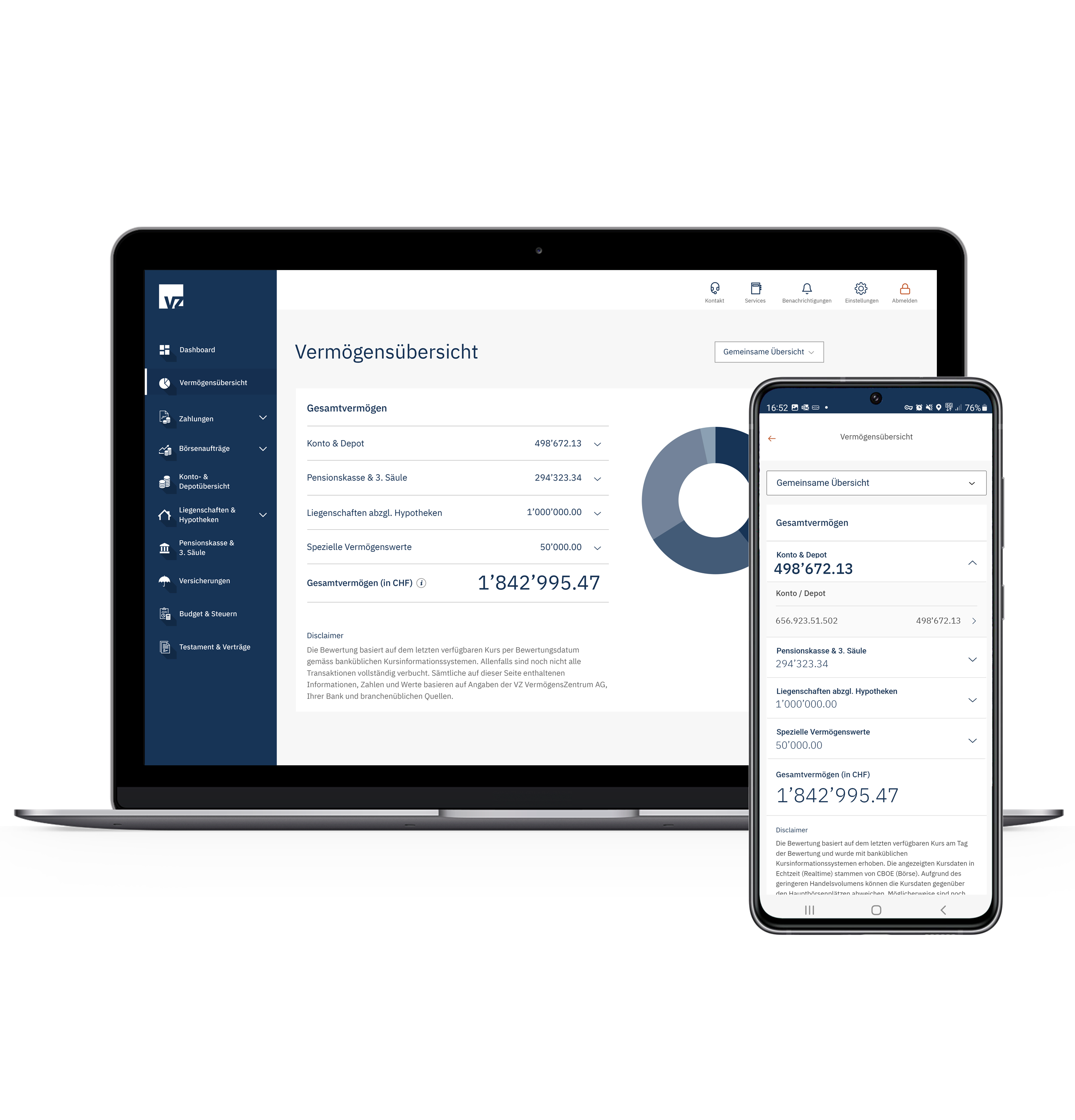

VZ Depotbank

A finance portal for the digital future

Thanks to the new finance portal, VZ Depotbank can make its entire range of products and services available to its customers in a user-friendly banking solution.

Head Banking Innovations

Roger Zuberbühler

Ready to transform your bank with cutting-edge technology?